Once again, it’s time for the big dance that is Kona. Or more technically – the Ironman World Championships. It’s when the fastest long-course triathletes in the world gather on a small island to collectively consume more electrolyte-filled drinks and gel packets in a day than more cities could ever down.

But like past years – I’m most interested in the data, specifically, the power meter data. As I’ve done for a crap-ton of years in the past, I’ll analyze the power meter count data that was released this morning by Triathlete Magazine, and talk about the trends. And for the first time in 8 years there’s a change to the power meter throne. Well, the king kinda-throne. Not the crapper type of throne.

A Bit of Backstory

For those not familiar, each year Lava Magazine (well, now Triathlete Magazine), in conjunction with a bunch of industry folks, count all of the bikes entering the transition areas. By ‘count’, I mean that they give them a complete rubber-glove exam of componentry. While this might be an interesting consumer publication tidbit, it’s really about industry marketing. It enables big companies to brag about domination in the bike industry for everything from the bikes themselves to helmets to wheels.

For example, here’s an ad from a few years ago (2014) that Quarq did almost immediately following the bike count numbers.

Starting in 2009, the Kona bike count added power meters to the list of counted parts. So we’ve now got almost a decade of power meter numbers to work from. Enough to start developing some interesting trends. For many that follow the industry, these trends won’t really be a huge surprise.

By the same token, it’s really important to understand that these numbers don’t paint an accurate picture of power meter usage across the board. Why’s that?

Because Kona Qualifiers are the pointy end of the pack. The super-pointy end. They also tend to be well beyond the normal triathlete Type-A mentality (that I fit into as well), which means that in addition to spending all their time on their sport they also spend all their money. They tend to gravitate to the more expensive options, especially for things like weight savings or if the word ‘carbon’ is involved.

Whereas the more weekend warrior road bike rider might not spend the same proportion of income in the sport, and thus is far more likely to buy cheaper power meters (à la Stages, 4iiii, Favero, etc…).

Next, remember that these are for units on the market as of the first few weeks of October. But in reality, I’d wager that 95% of athletes qualifying for Kona will have a fairly locked down mentality on gear – so likely any major bike changes, such as a power meter purchase, would have been done back in the spring (or at worst mid-summer), to be able to leverage that data for training all season. So any new power meter announcements or availabilities in the last few months aren’t likely to be reflected here. So it’s unlikely we’d see the impact yet of things like SRM’s EXAKT pedals, or the WatTeam Gen3 for example. And certainly not the PowerTap P2 pedals that don’t come out for another month.

Finally, note that the field at Kona is very dynamic in that while the age groupers on the podium at Kona will often return year over year, much of the age group field tends to view going to Kona as aspirational – and thus aren’t likely to be there 5 years running. Still, excluding the lottery winners, the overall athletic class of athlete tends to remain quite consistent year over year (and getting faster).

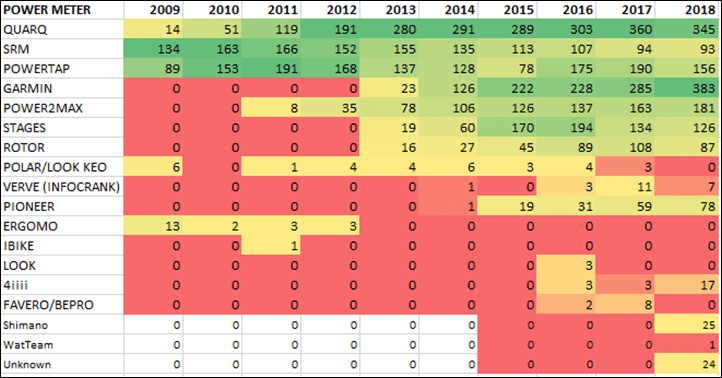

The Numbers:

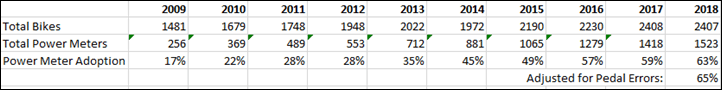

To begin, let’s start off with all the raw data from the past 9 years. I’ve ported it into a single table to make it easy to deal with. See the links at the bottom if you want to look at the individual yearly data straight from Triathlete Magazine. I’ve compiled it into some spreadsheets, and color-coded it for fun.

A crapton of quick technicalities to note here (seriously these are important):

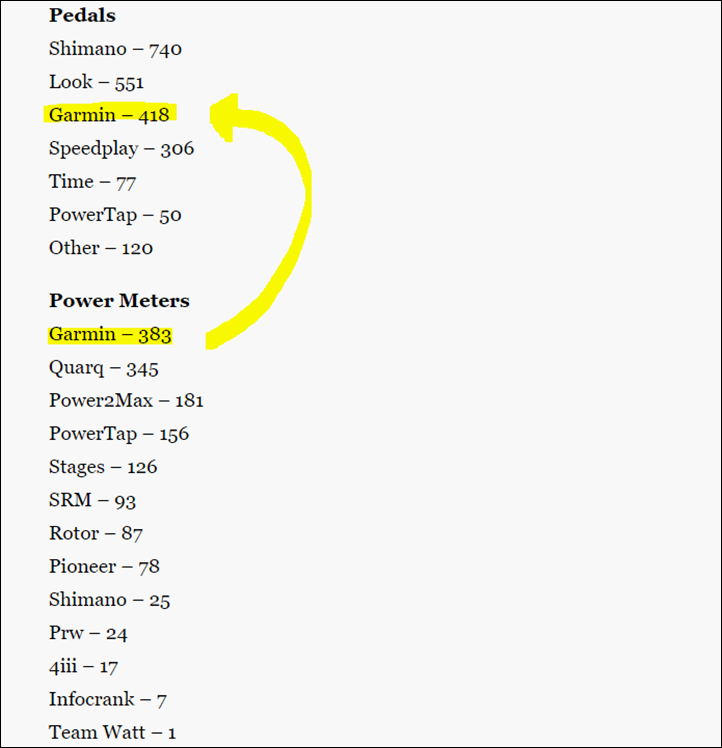

– There’s clearly some miscounted pedal-based power meters in here – especially Garmin ones. As you can see below, the folks counting the pedals counted 418 Garmin pedals versus only 383 Garmin power meters. I’m going to use the numbers in the power meter section, though clearly Garmin has even higher numbers than that lets on (since the higher number wins in this case).

– There’s no breakout of models, so we don’t know on PowerTap for example, how many are hubs vs chain-ring vs pedals. Same goes for SRM pedals vs SRM cranksets.

– Polar/Look appear to be counted somewhat differently over a few different surveys (breaking them apart and the combining of them). Earlier ones could technically be the Polar chain-based power meter, while later ones being the pedal. Either way, the numbers are honestly somewhat negligible here at only six units.

– Newer power meters simply weren’t available in earlier years, for example, Infocrank’s Verve didn’t exist 8 years ago, nor Pioneer.

– Inversely, some brands like Ergomo have long died off, but I kept them for historical reasons.

– On the official list there is a power meter titled ‘Prw’, which I’ve never heard of before. So I’ve included them in the totals, but not as a line-item. I suspect that might be Favero, since somehow they have zero units this year (from 8 last year), despite being overwhelmingly popular in the sales data I see.

– There’s also a listing for ‘Team Watt’, which I presume is actually WatTeam, though it could well be Team ZWatt. Hard to know. I gave it (a single unit) to WatTeam though since technically that’s the closest to it.

– I suspect there are cases where other relative unknowns might have been missed. It appears they’ve caught most brands, but if something is mostly unheard of (such as an Avio power meter), it might not be seen. These folks have to work super-fast and are likely not expecting the unknowns.

– While the top of the Triathlete Magazine piece notes 2,500 bikes counted, the highest totals value I could find for any category was 2,407 (saddles). So I’m using that instead so I suspect the 2,500 was the assumed value. Otherwise the totals were 2,259 bikes, 2,284.5 wheelsets, 2,392 shifting sets, and 2,262 pedal sets.

Here’s what I was referring to on the Garmin front. Also, you can see the PowerTap breakouts a bit in this too. Noting about 1/3rd the units were apparently pedal based (50 counted, versus 156 total PowerTap products).

So what about power meter adoption? Simply put – it continues to climb. And in fact, I bet it’s even higher than these numbers let on. I suspect some Shimano power meters were missed (since they can be hard to spot), as were Favero and probably a few others (even Specialized no doubt on some pro’s bikes). Either way, despite that, things climbed considerably again.

I also included a line item below showing what would happen if you added in the 35 extra Garmin-counted pedals (pedal data section) that didn’t show up in the Garmin power meter section (which would be a total of 1,558 power meters – or 65%. No matter how you slice it – up it went.

One of the challenges that we always have at Kona is that disc wheels are not permitted, primarily due to safety concerns with strong crosswinds on certain sections of the course. As such, people that may have PowerTap hubs in disc wheels aren’t really accounted for here. That said, year after year I suspect that’s a dwindling number of people, especially among the Kona crowd.

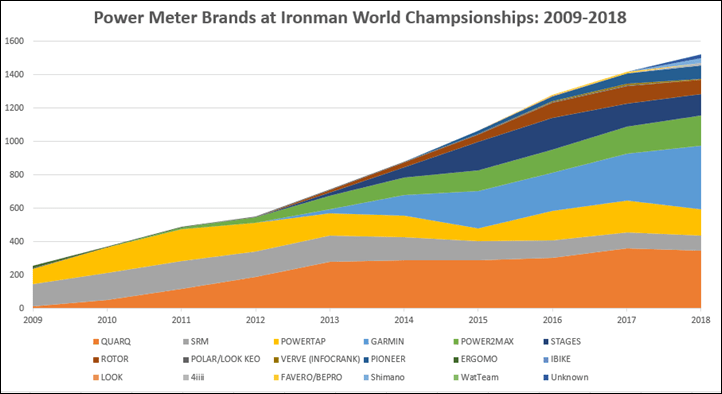

Next, let’s look at the brands more carefully:

First off, sorry there are duplicate colors. There are only so many colors to work with, and I just let Excel do its thing. All you really need to know to decode it is that orange section on the bottom is Quarq, and the lighter blue in the middle is Garmin.

Of course, most of the trends we see here aren’t surprising. Back in 2009, there were really only a few brands (Quarq, SRM, PowerTap, Polar, Ergomo). But it’s really PowerTap and SRM that dominated then.

Of course, a year later and Quarq is quickly in the running, and before you know it, by 2012 they held the dominant position all the way until last year (2017). But Garmin was clearly gaining on them, and this year they took the crown for the first time ever.

Why, you might ask?

Well, I think a few core reasons:

A) The Garmin Vector 3 pedals simply look better than before. There’s no doubt that most Kona athletes care very much about what their bike looks like as a whole, and with Vector 3 getting rid of the visually unappealing dangling pods that Vector 1/2 had, that makes it more attractive.

B) Garmin’s simply in more bike shops. Distribution matters here, and the fact that one can buy Garmin pedals at virtually any bike shop on earth matters. Same goes for online stores too. While Quarq has similar reach via SRAM’s ownership, stocking Quarq cranksets is a far higher bar than stocking a single type of Garmin pedals.

Now, keep in mind that the numbers probably would be even higher if Garmin hadn’t been embroiled in the Great Battery Cap Clusterfudge of 2018, whereby a non-trivial number of Vector 3 owners returned their units this past spring after dropouts and related issues. While I think that’s largely behind us, that no doubt had an impact – especially on pointy-end pack people who typically have less tolerance for data dropouts. But ultimately when Garmin is likely shipping 1,000-3,000 sets per week (and has been for exactly one year now), that volume is going to overcome almost any competitor.

Let’s talk about some of the other stand-outs in this list though. In mostly order of volume shipped:

Quarq: Obviously, Quarq is still a big player here. With 345 units, they were second and only lost a little bit of units-on-bike ground compared to last year (at 383 units). Still, it’s been over two years since Quarq last announced a new power meter – and more importantly, the trend is overwhelmingly going towards pedal based units. Still, I have Quarq units (including their most recent DZero) on a number of my bikes and they make an awesome and reliable unit. Not to mention their customer service is top notch.

PowerTap: If there was anyone here that should be looking at the numbers closely – it’s PowerTap. They lost about 20% of their Kona on-device volume this year, from 190 units to 156 units. There’s almost no doubt in my mind they lost units by people going from PowerTap P1 to Vector 3 – primarily for pedal weight/size. And while they announced the PowerTap P2 this week at Kona, I don’t see that helping them unless they substantially undercut Favero on pricing. There’s really no other way to say it: PowerTap needs to make a new pedal that has a body (and internal technology) that’s basically in line with their competitors. The trend won’t change directions until they do.

Power2Max: Despite doing virtually no marketing or new products this year, Power2Max continued to grow in size (for the 8th year in a row) – up to 181 units to claim the 3rd ranked spot on the podium. There’s good reason: They make solid products that are priced appropriately. One does have to wonder though if they spent even a bit of time marketing, at events or such, where they’d be. Still, good on them.

Stages: Despite releasing the Stages LR dual system earlier in the year, Stages remained mostly flat with a slight drop from 134 units to 126 units. Given the massive drop they saw the previous year – I think that might actually be a bit of a turnaround to stop the bleeding there. Again though, this is the one company that’s likely not represented well on the Kona charts. In reality, I suspect they probably ship more power meters than anyone (or are just behind Garmin) – just to a different budget category.

SRM: They also seemed to stop the bleeding this year, only going from 94 to 93. Given they only started shipping their SRM EXAKT pedals in late July, I don’t expect we’d have seen many of them. And, given they might not be easy to spot – I suspect a few were probably missed on this count. Next year will be what matters here.

Pioneer: I’m always impressed with Pioneer’s numbers here. And this year is no different – they sat at 78 units, which is solid given how often they seem to slide off of people’s radar. This was up from 59 the year prior, so a nice little riser. To think they’ve almost eclipsed SRM and even ROTOR is kinda astounding. Perhaps there’s something to that consistent and yearly release cycle they’ve got. Hey, if it works for Apple…

Everyone else: For the most part, it was minor shifts between everyone else. Shimano did score 25 of their new power meter units on bikes though, which isn’t too shabby (they just started shipping last fall). And 4iiii went from 3 bikes to 17 bikes. As I noted above though, I suspect some pedal based units were missed – especially Favero ones. Given Favero’s growth this past year, for them to go from 8 units to 0 units doesn’t make much sense.

Wrap Up:

Once again, it’s no surprise to the majority of the field using power meters at Kona. We saw a bit more growth this year than in years past, which is good. I suspect that’s fueled by there simply being more choice in the market than ever before across so many price points.

The past 12 months has actually been pretty quiet for new power meters (as I outlined in my keynote speech last week), and I’m not convinced we’ll see much different next year either. As noted, with so many announcements typically tied to Eurobike or Interbike, these shows are often too late to make a dent at Kona.

Perhaps though if a startup like IQ2 can get off the ground (read: ship) with their budget-priced units, we’ll see a shift towards even more adoption. But ultimately, any startup has to prove their units are accurate with independent reviews from numerous sources. Simply shipping a piece of hardware out the door doesn’t mean it’s an accurate power meter (as we’ve seen with other crowd-funded power meters).

While this year didn’t include aero sensors in the line-up, it’d be fun to find out how many (if any) Notio Konect sensors are in use out there at Kona today (they started shipping back in July). VeloComp’s AeroPod just shipped this past week, so that’s unlikely to be on bikes at Kona this year – but I’m willing to bet if people comb through the race day photos, they’ll find at least a handful of people using the Notio system. We’ll see…

With that – thanks for reading!

Note: This year, and many of years past data is from Lava Magazine and Triathlete Magazine by a collection of industry folks that survey the bikes upon check-in. Links to all past data sources are listed here: 2018, 2017, 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009.

FOUND THIS POST USEFUL? SUPPORT THE SITE!

Hopefully, you found this post useful. The website is really a labor of love, so please consider becoming a DC RAINMAKER Supporter. This gets you an ad-free experience, and access to our (mostly) bi-monthly behind-the-scenes video series of “Shed Talkin’”.

Support DCRainMaker - Shop on Amazon

Otherwise, perhaps consider using the below link if shopping on Amazon. As an Amazon Associate, I earn from qualifying purchases. It doesn’t cost you anything extra, but your purchases help support this website a lot. It could simply be buying toilet paper, or this pizza oven we use and love.

Can’t believe there were no limits powered meters there’s !

One other bonus with Garmin is that you can put them on pretty well any crank set, including, but not limited to, Dura Ace 7400, assuming of course that you can get your old pedals off.

If I were a gambling man, I’d put money down on the people doing the counting assuming that “pedal pod = Vectors”, and, with the missing pedal pods, just assumed that the Vector 3 pedals were regular Garmin non-power-meter pedals. That’s my best guess. It could be wrong, and honestly, it doesn’t really matter. Either way, Garmin has overtaken Quarq – which surprises me a little bit; I would’ve thought that it would take a bit longer for the fix to the battery cover (assuming that it is a complete fix) to work its way through into the market.

Pedal based power meters is the path forward, while a crank based was/is a dead end… I told you long time ago.

Obviously, Garmin has got the From Zero to Hero award…

Well anything other than pedal will be what I will always use. There are a couple reasons, one is I use speedplay. Two is I also ride gravel so syzrs or candy’s on on those bikes so they have crank arm meters, in fact “road” pedals are only half the market or less where crank based meters can be used in all disciplines. Three for no other reason than to prove you or someone else wrong. So very many “experts” that just need to be happy with choices rather than being correct about something that doesn’t even matter. ?

I actually don’t think crank-based is dead. In fact, I suspect long-term it’ll win. But not until Shimano:

A) Makes an accurate power meter

B) Decides to zero out the price of the power meter aspect for Ultegra & DuraAce.

Once it does that, it’s mostly game over. Campy and SRAM will be forced to follow-suite, as well crank arms manufs of other brands/usages.

Given Shimano hasn’t managed to do ‘A’ yet, I suspect it’ll be some years before that happens. But eventually it will.

There are potential antitrust risks to zeroing out the price of an integrated powermeter. If you have market power in one segment (as Shimano/Campy/SRAM almost certainly do), then you’re generally not supposed to “tie” your product to the purchase of a product in another, competitive market. Your former employer got into trouble with that (among other things).

You’re misunderstanding – I’m simply saying it’s going to be default in their higher end products.

There’s no law that says you can’t do that at all, nor does it come anywhere near antitrust (on so many levels in this market).

It’s self-evident that pedals will win out. It’s already happening as the numbers show.

Who knows if niche pedal makers like Speedplay will ever end up with power meters in their products (as I understand it, they don’t license their design, unlike Shimano). But it doesn’t matter — they’re niche.

Shimano can’t afford to “zero out” the cost of a power meter any more than anyone else. Like all multi-tier product companies, it depends on the high margins from its most-expensive products. The cost of the components for power meters is sufficiently high that Shimano would lose most of that margin if it included them at the same price.

The typical component cost for 3rd party power meters attaching to Shimano cranksets is under $20. Some even a bit lower.

Just to be clear – it’s not just me saying this – it’s the 3rd party power meter companies themselves. They all know this and talk about it every time i see them, the day is coming, it’s just a matter of when.

yep. that is the future of PMs

every £3k shimano-based bike…(or whatever the actual price point) will come with a PM and Di2

it will likely start with just duraace and eventually get rolled down to ultegra

shimano’s competition would be crazy not to follow suit

that only leaves a specialist high-end niche for PMs

AND a large but very competiitive lower/lower-middle end.

ultimately that means cheaper stuff for the masses

ultimately PM comapnies with large volumes/high market share will be the ones that survive

I’m not sure if cranks will dominate. my internal logic tells me that pedal-based solutions make more sense. although I suppose its much easier/cheaper to make a cheap crank-based solution and that fits in better with the economics, above

*ALL* the PM companies know this (I’ve asked some). They probably ALL have plans. They probably haven’t told them to me or anyone for obvious reasons.

I dont see pedal based solutions dominating the world anytime soon. And I for sure wouldnt rule out Shimano building a basic pm into their dura ace cranks per default. They for sure can afford it and it makes sense for them to create pressure on competitors like that.

Shimano doesn’t at all depend on the margins of their highest end tier products. Im pretty sure the gazillions of Shimano SIS/Acera/Tourney/Altus/Alivio whatever low end products on cheap bikes all over the world is where the bulk of money comes from. Not from the few aficionados that afford dura ace equipment. High end enthusiasts regularly overestimate their economic importance especially seeing how Shimano is not a boutique manufacturer like ceramicspeed or zipp even.

Besides if Shimano builds these cranks completely in house from a piece of metal to a complete pm-crank the added cost of this whole endeavor would be way below what we would expect from say a 4iiii sensor and glueing it to a dura ace crank. Theyd give it a small price increase and then make them pretty much without losing any money on it.

Personally I think Garmin benefits from the ease of installation, the popularity of look pedals and its already widespread eco system but I cant see them taking away market share of crank based PM beyond a certain point. Just to name one reason, in the stats above, Speedplay sans PM-pedals represents something just short of a 20% share, thats not exactly niche and you will not easily persuade speedplay users to swap to keo style pedals.

Also theres no cycling dynamics on BT Smart so many polar/suunto users may be less inclined to take a look at Garmin when theres really aggressively priced crank based options out there. Not to mention that established options like SRM and P2M are known to “simply work” out of the box.

No, that’s actually exactly what I”m talking about. If you make something a default “part” of your product when it was previously an add-on, and the add-on was sold in a competitive market by lots of third parties, that’s “tying.” It’s potentially illegal in the EU and in the US. SRAM already sued Shimano for tying in the early 90s (they settled out of court, but SRAM stopped the challenged practice).

Anyway, here’s a primer on tying: link to americanbar.org. The same basic principles apply in the EU. You’re right that there’s no law that says you “can’t do that at all.” The law is complicated to apply in practice. That’s why I said there are potential antitrust risks, not that “this is illegal!”

There isn’t a power meter you can buy as a separate product now. You buy a crank from Shimano that already has a power meter or you buy one that doesn’t. Fails the two separate products test. Also having a power meter in the crank won’t stop any action done now by other companies. (pioneer, 4iiii, stages, etc can still glue whatever they want to the cranks and no modification will be to make it harder to use a strain guage on the cranks)

I get this feeling it won’t be zeroed out so much as when they replace the current R91xx cranks the R92xx cranks will just have power meters built in and then when its time for the R80xx cranks to be replaced the R810xx will have power built in. Makes it easier to justify ultegra over 105

I realize that us CX/MTB riders are a slightly smaller market for power meters, but until there is a power meter that’s as easy as pedal-based but isn’t Look/Keo, there will still be a place for crank/spider meters. Look/Keo doesn’t even have the slightest of showings in this realm (b/c that cleat sucks for walking anywhere and especially over rocks and mud). Further, Shimano’s SPD pedals suck in frozen mud. I’m hoping that the iQ^2 works out in the long run so I can use my Crank Brothers pedals, but until then crank-based/chainring-based meters will stick around.

Eli, the “two separate product test” is much more complicated than that. You can’t just slap a power meter on a crank and say it’s one product. The key question (according to the leading Supreme Court case) is whether consumers actually WANT to purchase the products separately. So car stereos aren’t considered a separate product from cars, even though they can be purchased separately, because the overwhelming majority of consumers would prefer that the car be bundled with the stereo. Determining consumer demand typically requires expert testimony by economists who have actually done studies.

Also, tying has nothing to do with whether it’s POSSIBLE for a third party to attach their product. The whole point of tying law is to prevent the situation that Ray is predicting: where one company bundles a product so that even though consumers COULD buy another version of the product, very few will because it would cost them extra to do so. For instance, if you build Internet Explorer into your Windows, then consumers are far less likely to purchase Netscape (recall that in the 1990s, browsers weren’t free like today).

Again, I’m not saying that Ray’s prediction would be clearly illegal, just that it raises concerns. For what it’s worth, I used to be a practicing antitrust attorney, and I’ve had numerous discussions about tying with enforcement personnel from DOJ Antitrust.

What I find interesting is that people will generally keep their PM for quite a number of years and given the expense probably only have one. If we assume that most of the field will return for multiple years the news for Quarq is even worse because their numbers have remained relatively static. It’s no surprise that Garmin are doing well, but if you (pretend the whole field returned) take the previous years numbers away from this years then Garmin really are smashing it. Suggests people are actively selling their other devices for Vector 3. Given the various issues with Vector 3, the battery cap being just a small niggle compared to the huge dropout issues and requirement for baby oil faff this result is pretty surprising.

I’m pretty sure, as @dcr points out above, that these numbers do not exactly mirror what is selling in the ‘real world’.

My partly educated guess would be that ASSIOMA sells similar amounts to Garmin Vector 3 – which is VERY different to the above stats.

I think the REALLY interesting question is WHY the stats above are notably different.

Sponsored athletes, miscounting of Garmin pedals, Kona atheltes possibly wealthier on average, etc etc

I’d say probably that Kona athletes are more willing to spend more rather than being wealthier, although they may well be wealthier too. My point was really that Quarq might have sold zero units in the last year, which is going to take quite a while to shine through in this kind of survey. The fact that Garmin have taken the market so quickly kind of shows people wanted the Vector 3 form factor, which raises questions about the P2 pedals success too.

I don’t consider myself extravagant with my bike purchases. Exactly zero of my multiple power meters were bought new. Ebay is your friend when it comes to acquiring extra luxuries like power meters.

“My partly educated guess would be that ASSIOMA sells similar amounts to Garmin Vector 3 – which is VERY different to the above stats.”

I totally agree that Assioma pedals aren’t correctly/properly represented here for all the reasons noted above.

However, I suspect that our respective partnerships (CT/PMC) have a skewed view on Assioma sales compared to the average online retailer/LBS. Mostly because you and I are ‘enlightened’ ;) enough to know that Assioma is a superb option and present it on the level playing field it is to other power meters. As such, our readers (generally) respect our opinions and include Assioma as an option.

However, when I talk to random retail shops (like at Interbike a few weeks ago) – virtually none of them had heard of Favero/Assioma. And from a pure distribution point standpoint they have (for example) only a handful of US based retailers/distributors, whereas Garmin has basically not just every LBS/online shop, but also all sorts of totally random places too that also just sell Garmin gear. Globally I suspect shipments are probably like 30:1 or higher.

Of course, it’s just a swag. Every company asks about the power meter market size, and I’m just using a pile of data points which don’t really capture the full picture (because frankly, nobody has the full picture, even Garmin or Favero).

made me smile, thank you! the week is complete

#enlightened

#distribution #doh

A quick glance at the pro setups on the TriRig site suggests that more pros were riding Quarq than any other brand. But PMs are going to be table stakes in any Ultegra-level and above complete bike. Giant and Spesh are already heading that way.

My guess is that in the next three years, all of the Spesh-sponsored pros will be on the Specialized-4iiii set-up, Giant will probably jump back into tri and push their PowerPro, and Shimano (or more likely one of the upstart gruppos like FSA) will have an integrated PM in their crank or spider. (The pedal-based PMs will survive thanks to manufacturers that insist on introducing infuriating new BB standards that have limited crank options.)

From my experience with triathlete (working retail and coaching) I would say that this data should be seen more as an evaluation of the marketing strategy of a company. Garmin is very popular amongst triathlete for no other reason than triathlete think it’s “cool”. I have seen more time than I wish, triathlete buying the top of the line Garmin without knowing if if’s the right one for them cause “it’s gotta be the best one” since it’s Garmin and the most expensive. And it’s the same thing with bike, wheels, kit, etc. triathlete are very specific in there choice of gear but the decision is often based on the general opinion of a brand rather than the features or quality. Triathlon is unfortunately a sport where appearance is often more important than performance.

I certainly do believe that Garmin for years has been nothing more than a trendy “me too” purchase.

Dude have you seen triathletes, I’d rank appearance as their lowest metric.

Appearance of their equipment :-p

Are you sure people buy power meters for their looks? The Vectors have simply been among the cheapest options, and Favero (the only pedals undercutting Garmin pricewise) only arrived ~3 years go, so perhaps athletes haven’t been reassured about reliability and customer support yet. Plus pedals are super easy to move between bikes, obviously – a bigger plus for triathletes than pure cyclists.

Watches are another thing. People will sacrifice functionality for looks, big time.

Well, the crank arm based PM has an advantage of ridiculously cheap second hand units on a market. Starting from 200 EUR…

Despite of the good price tag it will be difficult to find a proper one, because you must also consider Bottom Bracket type (Hollowtech, BB30, MegaExo) and crank arm length…

Not only the Pros, but amateur enthusiasts like to experiment with crank length, manufacturers, style and weight.

For those reasons the second hand market is getting flooded by this type of PM…

Pedal based PM can be easily switched between bikes, it is just a matter of Buy and Ride…

…and Vector3 can detect saddle in and saddle out pedaling, which is a useful feature…

Presumably those units are on the market because their owns have bought Vectors…

Since this is a power meter post – any news/thoughts on a power meter for mountain biking?

It seems like a huge opportunity for someone if they can get it right…

This, over and over. All I ask for Christmas – two-sides power meter for MTB…

link to rotorbike.com

Happy Christmas!

link to stagescycling.com

link to power2max.com

link to srm.de

link to 4iiii-innovations.myshopify.com

link to powertap.com

Enough for most nights of Hanuka. (why you’d want that many types? shrug)

I think your best bet is a Power2Max NGeco MTB. But you would need to be using a direct mount crankset for best options with P2M.

As for Rotor: $1400 for a crankset+power meter? Are they on crack?

Get a Race Face Turbine or Aeffect and run the P2M… if you’re willing to spend the money (it’ll put you in the $800-900 range). The Turbines are light and inexpensive and allow 1x. But I might be showing my bias since I switched to 1x about five years ago for mountain and CX and haven’t looked back.

If you want to spend less, look at the Shimano XT crankset (heavy) and a 4iiii Precision.

I just put a power meter on my new gravel bike… not exactly mountain biking, but similar in that it’s offload and big cleats are a pain in the ass. I went with the Quarq d-zero after talking to some people who already have them installed… the “it just works” factor is important to me and I’ve heard nothing but good things.

Be careful with crankset +powermeter weights here. If my arithmetic is right then the ‘light’ Turbine with P2M spider will be about 60 g heavier than the ‘heavy’ XT M8000 crankset with 4iii Precision. P2M spider is 151 g vs only 9 g of 4iiii pod. The upside of P2M of course is that it captures power from sides (but not L and R separately), while 4iiii is single side only (doubles left hand side power),

In fact I think that XTR FC-M9000 with 4iiii comes out lighter than even the super duper RaceFace Next SL G4 Carbon with P2M spider. Ok, Race Face wins in the weight department if you go with their Cinch power spindle (65 g weight penalty vs 151g for p2m), but it is a) NDS power only (like 4iiii) b) I have not seen any serious review that looks at the accuracy of RaceFace cinch power meter.

I’m in the same boat . . . D Zero on my TCX. Absolutely love it. I have a D Four, and D Four91 and yes, they all just work.

Pedals are great for triathlon but I would be curious to know how they are impacting other markets… gravel and mountain biking in particular. I just bought a new Warbird and didn’t want to use any of the pedal platforms as many of my races have hike a bike sections so large cleats are a big drawback. I went with the Quarq d-zero after talking to a few people and am impressed in the short time I’ve had it.

Do you see a future for aeropod/powerpod ? Maybe being bought or in partnership with Garmin Wahoo etc combo GPS Cycle Comp with PM?

I expect all aero sensors will adopt the ANT+ aero sensor standard (because quite frankly, if they don’t, they won’t gain market share when something like 98% of GPS head units used to upload to platforms like Strava are Garmin). And, the other 2% of the big names also plan to adopt the ANT+ standard for aero data, including Wahoo.

In the case of AeroPod specifically, I doubt we’d see Garmin buy them given that Garmin bought Alphamantis. But as of today, AeroPod is already compatible with Garmin devices via their Connect IQ data field, which is a good stop-gap until the standard is released.

By the time you get to Kona you know what your power output should be on the bike portion of the event.

Don’t most triathletes focus primarily on HR during the race?

Is Xert the only power training platform attempting to factor in HR and HRV on a day to day basis?

link to velonews.com

Xert doesn’t do anything with heart rate to my knowledge, its all about power data. It just displays it

Xert’s background is in HR modeling. They want to incorporate power data with updated HR modeling so their adaptive training method can be applied across multiple disciplines whether using a power meter or HR monitor or both.

Where are you getting this from? Everything is power that it uses for calculations link to baronbiosys.com

Bioshift and Xert are both based on the use of power data. But what about heart-rate data and exertion? What happened to all that?

This is will be our third project: taking heart-rate data to new levels of analysis.

So not using HR now, and never did use HRV. You use don’t have any HR data in your rides Xert will interpret the rides the exact same as if you had it

By “attempting” I meant working on it. They aren’t there yet but they at least talk about it Xert already addresses the main problem with cookie cutter workouts during the effort portion. HR modeling should allow then to modulate both effort and recovery sections more effectively.

I get why the cycling world went gaga over power meters but before power there was HR and before HR there was prescribed effort (LSD, fartlek, etc.). Isn’t it time to combine all data sensors (power, HR, HRV, more?) into a self-modulating biofeedback training system?

What other training platforms are working on this concept?

Getting back to the topic of counting power meters I think DCR is correct about the future where power will be included with top-end cranksets.

Perhaps top-end handlebars should include HR sensors. ; – )

Interesting whether 4iiii can continue the increase – 2 fairly successful pro teams (bora-hansgrohe and quick step!) used them this past season.

Don’t forget that they’re Specialized driven teams, so I would expect them to be riding the Specialized branded 4iiii from now on wards.

That in itself is interesting and I think shows a huge amount of ‘faith’ from Specialized, to go to 4iiii for their unit over one of the longer standing US brands. But I’d say it is very well placed and would expect others to go the same route. Giant obviously are, how about Cannondale?

Any Chance of a Giant Power Pro review in the future?

Yeah, I got their contact info at the recent ANT+ Symposium (they had a big contingent there). It’s on the to-do list to see what’s possible in the coming months.

First, gotta get through trainer season related items!

PowerTap, at least in some years, have given a 50% discount on power meters to Kona qualifiers – everyone, not just pro athletes. I don’t know if that policy changed, but that would be significant enough to move numbers up or down quite a bit.

Brands (including wetsuit makers etc.) have identified Kona as a marketing platform, effectively “sponsoring” even regular qualifiers, who are still a tiny fraction of the triathlon market. While there might still be something interesting in the data, I think the influence of sponsorship on these figures cannot be overstated.

True, though surprisingly I don’t think it’s impacting the power meter as much. I’m not aware of any power meter brand doing it this year either. And due to the higher turnover/change in Kona attendees each year, I don’t think it would carry over year to year.

That said – I’ve always been surprised that some brands don’t actually take advantage of this more.

Is there no “kona bike count” for running watches and / or bike computers this year?

Strava has locked things down this year, making that a bit more ‘challenging’. :-/

There should be one 4iiii power meter in 2015 because it was on my bike.

Yeah, somewhat to my point that sometimes units that are newer slip through the cracks.

Too bad they missed the Favero Assioma devices. I’m sure there were a few – certainly more than there were bePROs last year. By the way, I own a bePRO S – super reliable, strong signal that can be boosted using firmware if needed. But of course the Kona crowd may not pay attention to pricing (a major advantage of Favero products) too much, seeing as the Hawaii adventure alone (not including preparation, or fellow travellers) costs a European athlete around $6k+.