Ok, so it’s been a few weeks since Kona. No worries, by now all those who went to the Big Island have returned from the Big Dance. Which obviously makes it a perfect time to discuss the findings.

A bit of background:

For those not familiar, each year Lava Magazine in conjunction with a bunch of industry folks count all of the bikes entering the transition areas. By ‘count’, I mean that they give them a complete rubber-glove exam of componentry. While this might be an interesting consumer publication tidbit, it’s really about industry marketing. It enables big companies to brag about domination in the bike industry for everything from the bikes themselves to helmets to wheels. For example, I saw this ad this morning while browsing Slowtwitch:

Starting in 2009, they added power meters to the Kona bike count list. So we’ve now got half a decade of power meter numbers to work from. Enough to start developing some interesting trends. For many that follow the industry, these trends won’t really be a huge surprise.

By the same token, it’s really important to understand that these numbers don’t paint an accurate picture of power meter usage across the board. Why’s that?

Because Kona Qualifiers are the pointy end of the pack. The super-pointy end. They also tend to be well beyond the normal triathlete Type-A mentality (that I fit into as well), which means that in addition to spending all their time on their sport they also spend all their money. Whereas more of a weekend warrior road bike rider might not spend the same proportion of income in the sport, and thus is far more likely to buy cheaper power meters (ala Stages).

Next, remember that these are for units on the market as of the first week of October. But in reality, I’d wager that 95% of athletes qualifying for Kona will have a fairly locked down mentality on gear – so likely any major bike changes such as a power meter purchase would have been done back in the spring, to be able to leverage that data for training all season. Thus all of the major announcements for power meters that hit in the 45 days prior to Kona pretty much have no impact here (especially since those units aren’t available yet).

Finally, note that the field at Kona is very dynamic in that while the age groupers on the podium at Kona will often return year over year, much of the age group field tends to view going to Kona as aspirational – and thus isn’t likely to be there 5 years running. Still, excluding the lottery winners, the overall athletic class of athlete tends to remain quite consistent year over year (and getting faster).

The Numbers:

To begin, here’s the raw data breakout of the year by year standings:

Kona 2014 Power Meters

| Power Meter | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

|---|---|---|---|---|---|---|

| Quarq | 14 | 51 | 119 | 191 | 280 | 291 |

| SRM | 134 | 163 | 166 | 152 | 155 | 135 |

| PowerTap | 89 | 153 | 191 | 168 | 137 | 128 |

| Garmin Vector | 0 | 0 | 0 | 0 | 23 | 126 |

| Power2Max | 0 | 0 | 8 | 35 | 78 | 106 |

| Stages | 0 | 0 | 0 | 0 | 19 | 60 |

| Rotor | 0 | 0 | 0 | 0 | 16 | 27 |

| Polar/Look Keo | 6 | 0 | 1 | 4 | 4 | 6 |

| Verve InfoCrank | 0 | 0 | 0 | 0 | 0 | 1 |

| Pioneer | 0 | 0 | 0 | 0 | 0 | 1 |

| Ergomo | 13 | 2 | 3 | 3 | 0 | 0 |

| iBike | 0 | 0 | 1 | 0 | 0 | 0 |

Now, there are two notable data collection/representation caveats here:

– Polar/Look appear to be counted somewhat differently over a few different surveys (breaking them apart and the combining them). Earlier ones could technically be the Polar chain-based power meter, while later ones being the pedal. Either way, the numbers are honestly somewhat negligible here at only six units.

– Newer power meters simply weren’t available in earlier years, for example, Infocrank’s Verve just started shipping this summer. Thus, expect better trending in future years for those models.

Next, it’s important to remember the number of participants does vary year to year. So, taking that and layering in total power meters is interesting. In this case, it’s technically total bikes:

Kona Power Meter Adoption

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | |

|---|---|---|---|---|---|---|

| Total Bikes | 1481 | 1679 | 1748 | 1948 | 2022 | 1972 |

| Total Power Meters | 256 | 369 | 489 | 553 | 712 | 881 |

| Power Meter Adoption | 17% | 22% | 28% | 28% | 35% | 45% |

As you can see, the last three years has been roughly pretty consistent at about 2,000 athletes. Meanwhile, the power meter adoption rate has skyrocketed, especially in the last two years – nearly half the field is now using power meters.

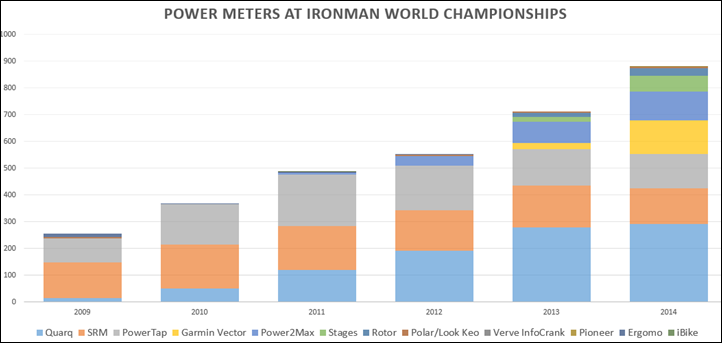

Next, let’s layer in all of the power meters over the past five years and how different companies have trended. The colors are coded down below and Excel has ordered the the colors left to right from the listing based on the most popular units in 2014.

(Note: Alex Simmons has used a similar format to the above each year in his quick data overview, so I have to give him full credit here for the graphical layout. That said, I’m looking to dive into a bit more analysis in this post versus just the raw numbers.)

Now, to begin, you’ll notice that there’s a ton more players now than there were in the past. As a result almost all of the growth in 2014 isn’t coming from legacy players (SRM/Quarq/PowerTap), but from newer power meter companies. Yet, the price points of those newer offerings actually vary. It would be easy to say that athletes are buying more power meters by buying cheaper power meters, but for Kona participants that actually isn’t really true at all.

For example, that block of yellow representing Garmin with Vector had a price point that ranged from about $1,299 to $1,799 over the past few months. Thus, even at those prices it’s roughly equivalent to a Quarq unit, and more expensive than the PowerTap. The same is true of ROTOR, which increased significantly despite having a near SRM-like price tag. Of course again, the average Kona participant tends to be far less price sensitive than the rest of the cycling or triathlon market thus a likely reason for increase in non-budget power meter offerings.

So let’s walk through each company and dive into some of the reasoning’s behind the growth or potential lack thereof :

Quarq: They still hold the most number of power meters at Kona, and that’s definitely something to brag about. At the same time, the numbers don’t lie – their adoption rate from 2013 to 2014 when compared to every year in the past has flat-lined. In 2012 they enjoyed 61% year over year (YOY) growth in Kona, while in 2013 they had YOY 47% growth. Here in 2014 it was only 4% YOY growth (in units). As I’ve said in other posts, while Quarq makes an awesome product, and they have continued to chip away at pricing in recent months – it’s still going to be very difficult for them to compete at current price levels going into next year.

SRM: When it comes to athletes who would most value the self-proclaimed “gold standard” power meter, things are on the decline. Despite significant overall power meter growth this year at Kona, SRM actually lost 13% of their user base year over year. Which of course doesn’t mean people are removing SRM’s, but rather that fresh blood into the Kona field certainly isn’t buying them. Until the company offers a product priced competitively (or even semi-competitively), this trend will undoubtedly continue. Perhaps though they’ll expand upon their hints for a sub-$1,000 power meter and deliver there though.

PowerTap: The Madison, Wisconsin based company’s numbers are a bit interesting here. From a numbers standpoint they declined at Kona by about 6%. However, that’s a bit tricky because Kona doesn’t permit disc wheels due to the strong winds. Thus, there may be participants that have PowerTap based disc wheels that aren’t really accounted for here. That said, I’m actually a bit surprised to see things flat-line for them here, despite their very well positioned price points. I suspect this is fully a case of Stages eating into that lower-priced market.

Garmin Vector: If there was any company that came away as as the clear trend winner, it was Garmin with Vector with 548% YOY growth and straight-up big per-unit numbers. Which quite frankly surprised me. They entered the market in the late August/early September 2013 timeframe, so this is really their first full year. I never would have expected they’d have come through with such huge numbers in that short amount of time given their price point. While I’ve shown the technology is just as solid as other power meters on the market, I think their Kona numbers are really more a case of distribution actually. Garmin products are in virtually every bike shop globally, and thus when it comes to people asking their local bike shop what to get, this has a lower barrier to entry.

Power2Max: They continue to put in strong numbers, and a 36% YOY bump is very solid. I suspect their continued downward pressure on prices in combination with their significant expansion of crank types is the reason here. They’ve introduced a slew of new crank models that give quite a bit of choice to folks. I think Power2Max may however be one of the indicators to watch going into 2015 though to see how much the upcoming lot of newer sub-$500 power meter brands eat into the mid-range price points.

Stages: Within the Kona numbers, Stages is probably the odd duck here. They’re the one unit that is most impacted by the Kona type-A mentality. That’s because despite enormous popularity in sell-through in the more mainstream market, the left-leg only aspect is probably not resonating as well with Kona participants. Still, they enjoyed 316% increase year over year, though, in units shipped it was only an increase from 19 units to 60 units. I suspect we’ll see them probably double next year, but I think that if 4iiii’s hits the market with an accurate product that’ll eat into their space quite a bit.

ROTOR: They surprised me a bit more last year with an initial showing of 16 units, and this year they grew a little bit (by unit count) to 27 units. I suspect the reason for slow growth is simply the price point here is very high. That coupled with initial teething pains (mostly prior to this past year) has led to slower adoption of the platform. We might see a pickup next year with their new left-sided offering, but within North America markets it’s still priced non-competitively.

Polar/Look-Keo: They came in at only 6 units here, which is likely representative of the fact that it’s actually nearly impossible to buy one of these power meters right now (the older WIND pedal ones). Well, that and the crazy price point. That said, as Polar is on the verge of re-releasing the pedals with a new Bluetooth Smart version any day now, I suspect we’ll see a pretty solid uptick in their overall numbers next year, especially with the left-only version they’ve announced as well.

Pioneer & Verve Infocrank: Both of these are fairly new to the market, but both managed to come in with 1 unit. I expected slightly higher for Pioneer given they’ve had some models in-market for about a year. For Pioneer I think we’ll see a more clear increase next year with the simplified North American installation options (previously it was a mess). Meanwhile, with Verve, they just got in-market this past summer. Like Pioneer I expect to see higher adoption next year for them.

Ergomo & iBike: Both of these officially had 0 units at Kona, per the survey. In the case of Ergomo that’s logical because they’re basically out of business. In the case of iBike though that actually might be more of a function of the process. That’s because unlike all of the other units here, the iBike isn’t physically attached to the bike 100% of the time. Rather, it’s a head unit. When the folks do the Kona bike count, they do it at bike check-in the day before the race, whereby many athletes wouldn’t bring their head units. While the iBike mount is fairly easy to spot, it’s not clear to me if the bike count folks would have been looking for it specifically.

Final Thoughts:

While there are individual company wins here, I think the bigger story is simply the fact that basically half the field is using a power meter. That’s huge. Now, it’d actually be even more interesting to know what participants of the field are using the power meter values as in-race guidance, or merely for post-race analysis. If you look at the number of athletes that are coached at Kona, it remains fairly high – so I suspect many are indeed actually developing training and racing plans based on power numbers. Whereas I think if you look at other segments of the cycling population, I suspect more are using it in post-ride analysis but not actively basing mid-ride decisions on it.

Looking at next year, I think we’ll continue to see another solid step-up in power meters, especially with at least two low-cost entrants on the docket for release next year, one of which will be available in the next month or two. Especially since both of those can do full left-right power.

With that – thanks for reading!

Note: This year, and many of years past data is from Lava Magazine by a collection of industry folks that survey the bikes upon check-in. Links to all past data sources are listed here: 2014, 2013, 2012, 2011, 2010, 2009.

FOUND THIS POST USEFUL? SUPPORT THE SITE!

Hopefully, you found this post useful. The website is really a labor of love, so please consider becoming a DC RAINMAKER Supporter. This gets you an ad-free experience, and access to our (mostly) bi-monthly behind-the-scenes video series of “Shed Talkin’”.

Support DCRainMaker - Shop on Amazon

Otherwise, perhaps consider using the below link if shopping on Amazon. As an Amazon Associate, I earn from qualifying purchases. It doesn’t cost you anything extra, but your purchases help support this website a lot. It could simply be buying toilet paper, or this pizza oven we use and love.

Ray,

Polar’s low adoption rate may also have to do with their lack of ANT+ compatibility. A lot of cyclists and triathletes already have Garmin Edge computers and likely want a PM that works with it. Polar’s will not.

No doubt, a very valid point.

I have found having my power2max very helpful for training and racing, and have improved race results to back it up. So the fact that a Kienle won in Kong without a PM, or even a watch, kinda blew me away.

You can’t compare you twith someone like Kienle. He surely trains a lot with perfect monitoring, but in racemode, he has Build-in monitoring. His idea is to be the First, Not to Finish in a Special time. Athletes like him have very Strong Pacing Skills.

I wonder also if the high adoption rate might be driven partly by the fact that those athletes that train with power may actually be better qualified to do Kona. I really think that when power costs come down even the less than elite athletes (cough, myself) will be able to train much more effectively with power. In fact, I imagine much greater benefits may be had by those bikers, since the Kona athletes are usually pretty aware of where their FTP and incremental power is at. This argues, by the way, for even lower cost fitness devices, head units and watches to support power.

Very interesting numbers. Nearly 50% of the field at Kona using powermeters. One thing that I think hurts powertap is that a lot of athletes use them to train with in a training wheel, but then are unlikely to have another powertap in their race wheel – so I wonder whether we’re seeing the cheaper crank based monitors like stages starting to be the ‘second’ powermeter choice for people to race with.

Quite a few of the athletes that I coach started with powertap wheels to train with and were using carbon disc covers to race with, but are now buying stages cranks so that they can have other race wheel options and still race with power.

Interesting analysis all the same.

Thanks, Ray!

Odd. If they would install a left-crank based power meter to their bike, why they’d need a PowerTap wheelset?

They allready have the powertap wheel and feel its more accurate… And it give the left/right balance… So its better to train… But i agres its not ideal to use powertap in race… Because you would need a Carbon wheel with powertap… And that would reduce your options.

I’m really surprised to see the pointy end of triathlon with only 50% power meter adoption. I would guess the pointy end of bike racing (TdF) has upwards of 90% adoption and I’ve always thought of triathletes as being more tech savvy and willing to be early adopters.

I’d keep in mind that the TdF is the itty bitty tiny tip of the pointy end, whereas Kona is just the pointy end.

Eric… You are comparing pro riders that have power meters Because there team have sponsor… Triathele in Kona are all kind of people… Many of them have to pay everything they use.

A third (or maybe intermediate would be a better description) use case for power meters is using power data for training (in-ride guidance and/or post-ride analysis) but ignoring the power data during an actual race. If I had to guess, it would be that this use case scenario is more common among roadies (just cyclists) that triathletes.

I think there’s generally more adoption of powermeters at Kona because everyone knows that you need to evenly pace on such a long bike, and the best way to do it is to sit on a power number. If I managed to get into the lottery, I would by 2 things: a Power2max and a Flo60 or Flo90 rear wheel.

Is Polar Kéo Power Bluetooth Smart already available? Can it connect with the v800?

Thx

And can the v800 connect with other power meters with bluetooth smart (e.g. stages, powertap with bluetooth smart power cap,…)?

The BT variant of Keo is currently slated to ship here this month. And yes, it works with the V800.

The V800 can in theory connect with other BT power meters, per the latest update about 30 days ago. But in practice it doesn’t really work with any of them fully. I tried testing it out with all of them and in pretty much every scenario it failed in some way. Polar says they’re looking into it.

Thanx Ray for your fast reply. I hope they will fix it soon, i want to buy a v800 but with another power meter.

Your comment about the Garmin Vectors has some truth. I recently went into my LBS to ask about what it would cost to get a Powertap and the first thing the guy said to me was “have you heard about the new Garmin pedal power meters?”

Yeah, I suspect it’s a simplicity thing going on as well. Taking your PT example, they’d have to custom order the wheel + the hub, and then depending on if they bought a stock unit from PowerTap it’d come ready, or, they’d have to lace the hub into the wheel (more work). Whereas with Vector, they likely have a unit on-hand in the shop and can install it and have you out the door in 5-10 minutes. Quick sale, low overhead.

What about sponsorships? Could that factor be affecting the results? How many of the power meters were gifts?

I was wondering that. I think it might impact ROTOR and Polar’s numbers (upwards), though I can’t say I know how much. SRM might have a few, but they’re kinda squirrelly when it comes to what they call ‘sponsorships’, making it difficult to account for.

Stage for SKY :-)

Being a triathlon, Team Sky doesn’t normally participate unless you could the ultra-rainy stages of Le Tour as the swim. In those stages, Team Sky has historically done rather poorly.

Wonder how much frame compatibility affects the numbers? As an example, Stages won’t fit on some of the 2014 Cervelos which could hurt their numbers.

Hard to say. Most power meters have some form of quirk, be it crank compatibility, frame, etc… I suspect it might be a wash. But hard to say for certain.

I feel that in 2015 that number is going to skyrocket with the introduction of the 4iiii “stick on” power meter. My LBS guy is totally geeked about it & cannot wait until they are released. He is trying to convince me to get two of them for dual sided power (a proposition my coach won’t complain about). Even with a brand new Ultegra crank to replace my incompatible Vision crank, I would come in at under $1,000 for true dual sided power.

When you can keep your bike set up pretty much the exact same & still get power for as little as $400, you will be hard pressed to see a bike without some kind of power meter.

I cant help but think about what you said at the ANT+ symposium “what to do with watts.” I’d wager that the breakthrough will be by the company that can develop the “what” training side of power.