For those in the triathlon world, today’s the big day: Kona. Or more accurately called – the Ironman World Championships. It’s when the fastest long-course triathletes in the world gather on a small island to collectively consume a hundred-thousand gel packets. Following which tomorrow, there’ll be some 2,400 people unable to walk.

But what I’m interested in is the data. This first of two posts I’ll do will focus on the power meter side, and then in the next day or two I’ve got a bit more on the watches and bike computers people are using (thus, get your data uploaded to Strava if you’re competing!), in partnership with Shane Miller.

It’s been a couple of years since I did my yearly run-down of the Kona power meters, but it’s definitely time to get back in the game. So with that, let’s begin!

A Bit of Backstory:

For those not familiar, each year Lava Magazine, in conjunction with a bunch of industry folks, count all of the bikes entering the transition areas. By ‘count’, I mean that they give them a complete rubber-glove exam of componentry. While this might be an interesting consumer publication tidbit, it’s really about industry marketing. It enables big companies to brag about domination in the bike industry for everything from the bikes themselves to helmets to wheels.

For example, here’s an ad from a few years ago (2014) that Quarq did almost immediately following the bike count numbers. And Spoiler Alert: They can now say 6 years in a row:

Starting in 2009, the Kona bike count added power meters to the list of counted parts. So we’ve now got almost a decade of power meter numbers to work from. Enough to start developing some interesting trends. For many that follow the industry, these trends won’t really be a huge surprise.

By the same token, it’s really important to understand that these numbers don’t paint an accurate picture of power meter usage across the board. Why’s that?

Because Kona Qualifiers are the pointy end of the pack. The super-pointy end. They also tend to be well beyond the normal triathlete Type-A mentality (that I fit into as well), which means that in addition to spending all their time on their sport they also spend all their money. They tend to gravitate to the more expensive options, especially for things like weight savings or if the word ‘carbon’ is involved.

Whereas the more weekend warrior road bike rider might not spend the same proportion of income in the sport, and thus is far more likely to buy cheaper power meters (à la Stages, 4iiii, Favero, etc…).

Next, remember that these are for units on the market as of the first week of October. But in reality, I’d wager that 95% of athletes qualifying for Kona will have a fairly locked down mentality on gear – so likely any major bike changes, such as a power meter purchase, would have been done back in the spring, to be able to leverage that data for training all season. So any new power meter announcements or availabilities in the last few months aren’t likely to be reflected here. So it’s unlikely we’d see much in the way of recent announcements like Favero Assioma, Vector 3 (not shipping yet), Stages Dual (not shipping yet), and so on.

Finally, note that the field at Kona is very dynamic in that while the age groupers on the podium at Kona will often return year over year, much of the age group field tends to view going to Kona as aspirational – and thus isn’t likely to be there 5 years running. Still, excluding the lottery winners, the overall athletic class of athlete tends to remain quite consistent year over year (and getting faster).

The Numbers:

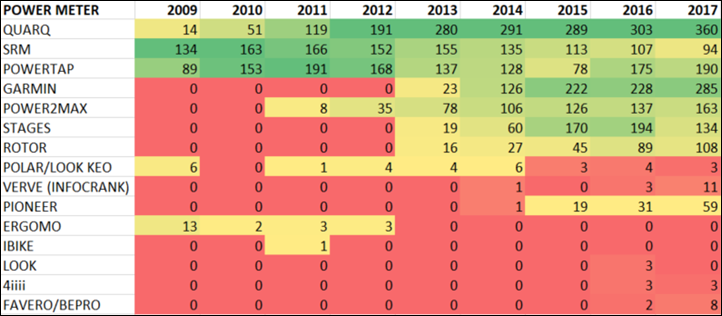

To begin, let’s start off with all the raw data from the past 8 years. I’ve ported it into a single table to make it easy to deal with. See the links at the bottom if you want to look at the individual yearly data straight from Lava Magazine. I’ve compiled it into some spreadsheets, and color-coded it for fun.

A couple of quick technicalities to note here:

– There’s no breakout of models, so we don’t know on PowerTap for example, how many are hubs vs chain-ring vs pedals.

– Polar/Look appear to be counted somewhat differently over a few different surveys (breaking them apart and the combining them). Earlier ones could technically be the Polar chain-based power meter, while later ones being the pedal. Either way, the numbers are honestly somewhat negligible here at only six units.

– Newer power meters simply weren’t available in earlier years, for example, Infocrank’s Verve didn’t exist 8 years ago, nor Pioneer.

– Inversely, some brands like Ergomo have long died off, but I kept them for historical reasons.– I suspect there are cases where relative unknowns might have been missed. Meaning, it wouldn’t surprise me if a Shimano power meter or two slipped through since they are hard to spot (as are 4iiii’s). Not tangible in the grand scheme of things, but something to consider.

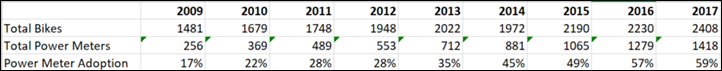

So what about power meter adoption? Well, we’ve definitely seen some solid climbing of the numbers, with the majority of the field now using one. Still, we didn’t see the big jump we saw last year in relative % compared to this year. Keep in mind though that there was a significant increase in the overall field size. So in actuality, total power meters in the field did increase (again).

As you can see throughout the years, the biggest jump was from 2015 to 2016 in terms of units (’13-’14 in terms of percentage). However again, this year saw 178 more athletes than last year and still saw an increase of 139 power meters over last year – albeit that makes only a 2% increase.

One of the challenges that we always have at Kona is that disc wheels are not permitted, primarily due to safety concerns with strong crosswinds on certain sections of the course. As such, people that may have PowerTap hubs in disc wheels aren’t really accounted for here. That said, these days I suspect that’s a dwindling number of people, especially among the Kona crowd.

Next, let’s look at the brands more carefully:

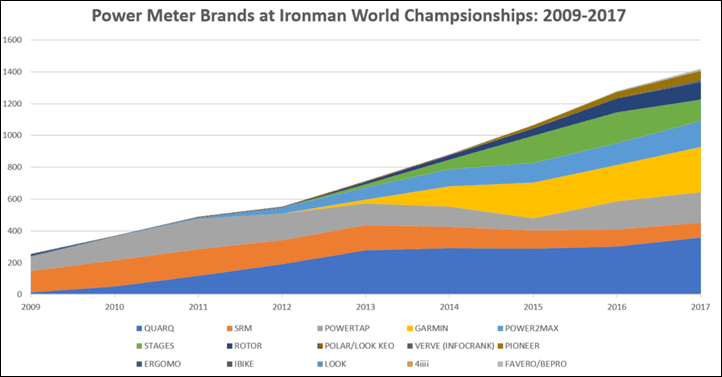

First off, sorry there’s duplicate colors. There’s only so many colors to work with, and I just let Excel do its thing. All you really need to know to decode it is that massive blue section on the bottom is Quarq, and the lighter blue in the middle is Power2Max, and the darker blue up top is ROTOR.

Of course, most of the trends we see here aren’t surprising. Back in 2009, there were really only a few brands (Quarq, SRM, PowerTap, Polar, Ergomo). But it’s really PowerTap and SRM that dominated.

Of course, a year later and Quarq is quickly in the running, and before you know it, by 2012 they held the dominant position and haven’t looked back since.

Why, you might ask?

Well, I think a few reasons. First is they’re a well-known, trusted, and reputable brand. The product fits well into the triathlon realm where many triathletes don’t actually have multiple high-end tri bikes like a roadie might have. So going with a single crank spider position unit works well. And their newer DZero unit is pretty solid.

But I think it’s more than that. I think that Quarq’s customer service (which is well known and discussed in triathlete-focused places like the Slowtwitch Forums), actually plays a key part in it. It’s well known that if you call Quarq you’re going to get a human on the phone almost instantly and they’re going to get you sorted super-quick.

Let’s walk through the other companies after Quark briefly though, with a few quick thoughts:

Garmin: Coming in at #2, they hold up at 285 power meters, about 50% more than their nearest rival – PowerTap. As I’ve said in the past, I think the main reason Garmin does so well here is simply distribution. They’re in almost every bike shop on earth, and thus easily available. Certainly, they make an accurate product, though one not as well liked by roadies due to the exterior pod design of Vector 1/2. With Vector 3 though and the pod-less design (which wouldn’t impact these results), I think they stand a very realistic chance of snuggling right up to Quarq next year in the 2018 rankings, if not eclipsing them. Pricing wise, Garmin isn’t much different than Quarq (actually cheaper in certain scenarios), so next year will be very interesting.

PowerTap: A couple years ago in the Kona count numbers they actually specified pedals by brand (as opposed to cleat type this year), so we could see how many PowerTap P1 units were out there. They didn’t do that this year, unfortunately. Still, PowerTap continues to do relatively well in these numbers, again likely due to distribution as well as brand reputation.

Power2Max: The Power2Max NG units that were announced last summer (2016) were severely backordered/delayed for much of the past year, so in some ways Power2Max got dorked a bit here likely, where people just cancelled orders and went elsewhere (though, Quarq was equally as delayed with their DZero lineup from last summer). Still, we’re seeing Power2Max start to lose the massive momentum they had a few years back. I think though their new NG ECO unit that they announced at Eurobike this summer will help that (since it’s sub-$500). But I think it’s also clear they’re starting to see the limits of not doing distribution (they’re direct to consumer).

Stages: Woah. They saw a massive drop in numbers here this year compared to years past. Sure, SRM lost numbers too, but dang, Stages really lost some numbers. But this was predictable in many ways. With left-only power meters no longer having much of a price advantage, people have chosen to go with full-sided units that capture all power instead accurately. Of course, Stages probably saw this as well, which is why back at Eurobike they announced their dual-sided system (Stages LR), which should start shipping in the next month or so.

SRM: As has been the trend for the last 6 years, SRM continues to lose market share. Again, no surprise here to anyone in the industry. They simply aren’t innovating fast enough or compensating for that with pricing. Consumers are demanding things like Bluetooth Smart connectivity (heck, even Garmin was forced to add it, despite owning ANT+), and as such, people are voting with their wallets and their requirements.

ROTOR: I’m actually impressed that ROTOR continues to make incremental gains each year. They don’t quite have the marketing prowess of the other companies when it comes to power meters specifically, but each year they keep adding a little bit more. For the most part, I liked their unit they introduced over the past year, as seen in my in-depth review.

Pioneer: The last of the big ones I’ll profile individually, Pioneer made huge strides this year – doubling the number of units they had last year. Sure, that might be easy when you’re talking low numbers, but that’s actually a pretty solid gap on these charts. Even more so since they don’t have as strong of marketing message as others, but they do tend to be fairly involved in pro teams, which may be trickling down here.

Everyone else: We didn’t see a significant shift from 4iiii this year, I suspect in part due to the same single-sided limitations that Stages has. Of course, 4iiii is doing dual these days, but I think a lot of people don’t realize that, or the cranksets just don’t fit what they want. Meanwhile, Favero added a handful more units this year as well. I suspect we’ll see a huge jump next year for them with the availability introduction of Assioma in the last few months. And lastly, Verve also picked up a few units too – no surprise, they make a good product.

Wrap Up:

It’s no surprise to see the majority of the field using power at Kona on the bike. Though, I will say I’m slightly surprised to see it only grow by 2% this year. I don’t know whether that’s due to a rash of products being delayed last year, or people waiting for the next new thing this year. Or just hitting the saturation point given the current prices. But it is something to ponder.

What I think might be really fascinating next year though is if they count aerodynamic sensors, as we’ve got 2-4 companies all working towards getting products in the market, likely by this winter or next spring. And the absolute target market for all these products in triathletes, and specifically, triathletes going to Kona.

Similarly, it’d also be interesting to know what percentage of people are using running power. Certainly today there’s really only Stryd (which is very active at Kona), but next year we’ll have Garmin, RunScribe, and others. Good times ahead, that’s for sure!

With that – thanks for reading!

Note: This year, and many of years past data is from Lava Magazine by a collection of industry folks that survey the bikes upon check-in. Links to all past data sources are listed here: 2017, 2016, 2015, 2014, 2013, 2012, 2011, 2010, 2009.

FOUND THIS POST USEFUL? SUPPORT THE SITE!

Hopefully, you found this post useful. The website is really a labor of love, so please consider becoming a DC RAINMAKER Supporter. This gets you an ad-free experience, and access to our (mostly) bi-monthly behind-the-scenes video series of “Shed Talkin’”.

Support DCRainMaker - Shop on Amazon

Otherwise, perhaps consider using the below link if shopping on Amazon. As an Amazon Associate, I earn from qualifying purchases. It doesn’t cost you anything extra, but your purchases help support this website a lot. It could simply be buying toilet paper, or this pizza oven we use and love.

A “small” island? Sounds like you’ve never been here, Ray!

?? it’s smaller than many islands outside of the Hawai’i group but that was my first thought too.

It is small. I was there this summer. It takes longer to cross the greater Cleveland or Chicago areas, let alone LA or something.

Way to compare apples to oranges, JimL. Hope you brought your bike with you when you came to visit. If you did, you’d know that riding from one of this island to the other is no joke. Cheers,

Bradley

Price saturation is definitely becoming the limiting factor. I would love to add one but I simply can’t justify the cost, especially until someone releases a meter I can reasonably transfer easily between 3 bikes.

Until someone makes a Limits-type transferable system that actually works or can sell me 3 matching units for less than the price of a new bike there is no way I can justify it to Mrs M.

I can’t think of any power meter easier to move between bikes than the PowerTap P1 pedals.

Possibly the New Garmin Vector 3 pedals, but they don’t seem to be shipping just yet (I’m still waiting for my pre-order).

I’d argue that the P1’s still take the cake on a technicality for being the ‘easiest’, simply because you can use any hex wrench, versus the Vector 3 needing a pedal wrench. Minor difference of course.

Which, doesn’t mean I’d recommend P1 over Vector 3 on the whole…but just on that tiny little factor.

How many of these athletes chose & bought their own power meter? As you mention, these are the super-elite athletes in the sport. It would be interesting to see how many chose their own vs. had it provided through a sponsorship/brand ambassador program.

But with 2400+ participants, these clearly are not only the super-elite (the peleton in the Tour de France has only ~190 riders). I’m actually surprised, though, that it’s not 100%. They can afford several thousand dollar bikes and a trip to Hawaii and not afford a power meter?

Good point. Even many AGers, especially the best ones, tend to have access to “sponsorships” that usually consist of club/bike shop discounts.

I for one bet knowing that would change the way we look at the numbers, but without *knowing*, we can’t really say.

Ray: When are you going to step up to the plate and launch your own intrusive “rubber glove” survey? I’m talking stealth intra-cavity sensors currently flying under the radar. With the recent death of the much hyped dehydration sensor device we breathless sports tech consumers expect no less from you. Not to mention hidden batteries and motors. C’mon Ray, when has the intrepid Rainmaker ever backed down from a challenge?

I think it’d actually be interesting to do a watch/whatever count with folks leaving transition on both bike and run. Unfortunately, I suspect there are only a handful of people out there that can quickly identify just about any watch on someone’s wrist or bike at a glance from a distance.

There is also photography. They don’t need to be able to know what it is if they can get a clear shot of it! Then YOU only have to sift through 2000 photos at your leisure.

Yeah, I think even in that case with moving athletes on a course it’d be really difficult to get the zoomed in type of shot you need, at the rate you need. Video would be ideal – but you’d have to be at 4K and with a high quality lens to catch everyone. Identifying iconic looking watches like the orange FR310XT is easy.

Where it gets tricky is picking apart things like the FR735XT vs FR235 (share almost identical shells), or stuff like the Suunto Spartan Ultra vs Sport (probably impossible at any distance). And even a FR935 vs FR735XT is tricky if you can’t get a look at the single grey button on one of them.

I thought of a startup based on video/photo analysis + machine learning tought to recognize brands/models of different gear. You film the start of a marathon in 4k and then sell accurate info to brands.

Don’t know whether there is a market for that but it seems like a very good use case for machine learning. If i can recognize a watch from a glance I’m sure I can teach it to an ML system.

This is fascinating. Good for Quarq – they have a great product and stand behind it. Really surprised that 4iiii doesn’t have more units out there. Perhaps they were missed, as you say. Really impressed that Rotor has done so well.

I suspect they were missed (a bit, not a ton). The 4iiii system, especially dual-sided is really easy to miss. Same with Shimano – which is even easier to miss, especially because people aren’t conditioned to it yet. I’ve certainly missed the new Shimano units on a few bikes at a quick glance.

With 4iiii, the left pod is a bit closer in to the bottom bracket than Stages is, which hides it a bit more there.

Could it also be that 4iiii dual-sided offering was not shipping in sufficient quantities? Perhaps it was better in the US and Canada, but at least in Europe the dual sided DuraAce was not readily available. At least that was my impression. Now we wait for the next iteration in the form of Podiiiium

Definitely a factor for sure, especially since like Power2Max and Quarq, it was mid-year before they were widely available (or less, as you pointed out).

Surprised stages have held up this long. At the low price discrepancy for full versus single side PM, I wouldn’t have thought anyone would have bought single side for the last couple of years now.

No Limits? ;)

One might say it was…off limits.

Hey,

first in Power2Max section link description probably should be the Power2Max NG units instead of The PowerTap NG units.

And secondly just out of curiosity I have question in relation to Polar chain power meter (first heard/read about it). How this work? I only found that it measure chain vibrations and chain speed, but how do you get power from that? Do you have an idea?

Thanks for the heads up!

I can’t begin to explain the details of the Polar unit in terms of practice. I do know they did file a patent on it, so one can look that up for it (it’s public now). Also, I know one of the DCR Readers is the inventor and floats around a bit. Might be able to do a better job. It was a bit before my time, sorry!

Vibrations in the chain like an electric guitar. link to biketechreview.com

Ray… do a notio konect depth review please!

I’ve gotta hands-on preview coming up! Just getting through the backlog!

Ray, do you know what happened to Look’s 3rd gen pedal based power meter? I wanted to do the upgrade from the BTLE onl version to the new one and sent my pedals in in january(!) and never received them back. Whenever I call them, I get answers like “within the next 2-3 weeks”…

I haven’t heard anything either. :(

When is limits breaking into the market? :-P

My Limits are still in the box. After reading all the user stories, I just couldn’t be bothered to try to install it :-)

When I reviewed the Pioneer Pedaling Monitor System review back in 2016 I emphasized that technically it is a great product that gives a load of data in advanced and professional usage scenario’s.(Returning from an injury for example, or improving your pedaling techniques).

However Pioneer really lacks the marketing message (and thus momentum) while competition is getting there with competitive dual sided alternatives.Especially in Europe … it is hard to get your hands on a Pioneer PM. :)

link to remo-knops.com

According to your data the biggest jump in percentage of field using power meter was between ’13 and ’14 (10%) not ’15 and ’16 (8%)

Good catch, fixed.

Though the biggest jump in raw units was 2015-2016, aided by both more units added but also the expanded field.

So…. when are you publishing the 2017 Annual Power Meter Guide? Did I miss it? I remember whispers of one in early September. I’m in the market and debating the merits of pedal solutions. I keep waiting for your wisdom, in a consolidated form, to inspire my CleverTraining purchase.

Interesting to see Quarq referencing this page :)! They have a link to it on their “KING OF KONA’S POWER METER COUNT” page on the Quarq website.