Google has just announced the acquisition of Fitbit for a cool $2.1 billion (USD). The move will undoubtedly drive change in the industry, though, not as much as one might think – at least initially. Don’t worry, I’ll explain in a moment. Like any acquisition, it needs to actually be approved by regulators, but that’s largely just a formality for this particular instance. Google & Fitbit expect that to occur in 2020, which is when the real work can begin.

It’s probably best to start off with where these two companies’ products fit in the market today. Fitbit, of course, being one of the biggest wearable players, though sliding in the last few years as Apple, Samsung, Xiaomi, and Huawei (and to a lesser but still visible extent Garmin) have seen their sales increase significantly (keep in mind that global IDC tracking isn’t a great indicator of North America/European sales). Apple sells approximately 20-25 million Apple Watches per year (and more than double that for the entire ‘wearables’ category). Whereas Fitbit has been in the 13-20 million ballpark the last few years.

Google meanwhile hasn’t sold their own watch device. Instead, they have Wear OS (previously known as Android Wear). That’s an operating system that’s largely focused on the higher end smartwatch with a similar battery profile as the Apple Watch. Meaning, it’s designed to roughly last 1-2 days. Exactly how long it lasts depends heavily on the exact partner hardware. For example, Polar’s M600 (Wear OS) fitness-focused watch tends to last longer than some other companies’ thinner watches. And similarly, we saw Apple decrease actual battery life this year in the Series 5 from past years. Again – it all depends on the hardware under the covers.

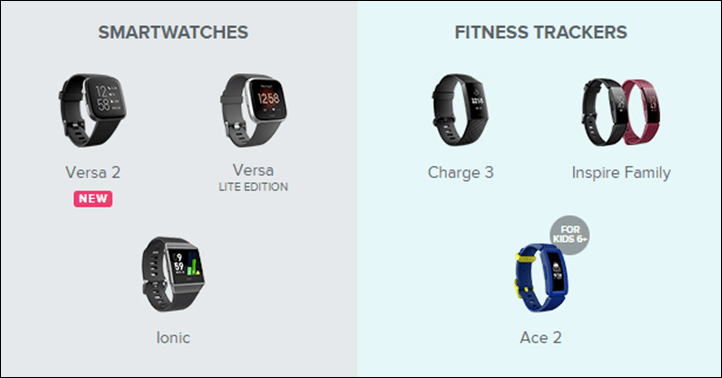

Battery aside – Fitbit and Google do have wearables overlap, but it’s kinda messy overlap. For example, Fitbit’s top-end device – the Ionic (priced $200-$250 depending on tidal and moon phases) has music, GPS, and contactless payments. Wear OS devices in that category tended to start from the same price point and increase depending mostly on materials used. Fossil had countless watches all in that price range. However, Wear OS wasn’t situated well for the less expensive all-day activity trackers that made Fitbit popular.

The battery demands of Wear OS (like WatchOS from Apple) simply didn’t allow that. They are blow-torches in the battery department in comparison to the much longer-lasting Fitbit (and Garmin/Suunto/Polar/etc…) wearables. A large part of that is the screen – Wear OS devices tended to have far more vivid screens. And as we saw this year with Fitbit, Apple, and Garmin introducing always-on screens like Samsung has had – when enabled, it more than halves the battery life.

Next, if we look at the health side of things- while Google has their health platform, it doesn’t have anywhere near the depth of Fitbit from a social fitness tracking standpoint. Nobody really does. That’s why Fitbit has succeeded to date: Their platform is engaging. Even looking to Apple, for example, one can see the huge lack of social engagement between Apple Watch users. You can do basic competitions, but the methods and challenges that Fitbit has, exceeds everyone else’s capabilities.

What does it mean for FitbitOS & Wear OS?

So the real question here is: Which OS wins?

The easy answer is ‘Wear OS’, and to an extent, Google says that as well. Their SVP of Devices and Services, Rick Osterloh noted that this “an opportunity to invest even more in Wear OS as well as introduce Made by Google wearable devices into the market.”

But the challenge with that broad-brush statement is somewhat twofold:

A) Wear OS isn’t viable for Fitbit’s non-smartwatch activity trackers

B) Wear OS is still a battery beast

Not to mention that Wear OS still has relatively little uptick in apps (just like Fitbit does). Sure, the app stores are full of apps, but very few that you’ll actually use beyond a cursory one or two time glance.

Realistically – Google and Fitbit are going to have to keep both platforms running, likely for many years. But that might not be all bad. Take the lower end wearables (the Inspire and Charge families), there’s no reason to even bother trying to port Wear OS onto these devices. Instead, Fitbit/Google will likely keep them on the platforms they’re on (the core Fitbit platform that was there prior to FitbitOS proper). They can add in things like Google Assistant down the road (they added Alexa to the Versa 2 this past summer) and since there’s no apps on these, much of the benefit of Wear OS is negligible or non-existent.

Meanwhile, you’ve got the Versa and Ionic lineup. These have strong overlap with Wear OS and are likely to be canned from an operating system standpoint. At first glance, you might assume that FitbitOS is newer than Wear OS (or Android Wear). But in reality, one has to remember that FitbitOS is essentially just a spin-off of the Pebble operating system (remember, Fitbit bought Pebble). In fact, some of those lead Pebble engineers are still there leading this platform. But, I can’t see any scenario where they keep FitbitOS. There’s simply no reason to.

All of the fitness and lifestyle type interfaces and functionality that run on a Versa or Ionic type watch can easily be ported over to run on Wear OS. Sure, there will be differences, but because Fitbit’s products are fairly modular and also less deep in individual functions than say something like a Garmin watch, it’ll be easier to stock replace pieces like the music player or even basic run tracking. Wear OS does those just fine today – and not appreciably different than Fitbit.

So in short – I’d argue FitbitOS goes away, Wear OS continues, and basic Fitbit trackers stay the course on their proprietary platform as they have for more than a decade.

What does this mean for Fitbit users?

And this is where things get a bit messy. See, they say almost nothing about existing Fitbit users in their press release except this single line item:

“Consumer trust is paramount to Fitbit. Strong privacy and security guidelines have been part of Fitbit’s DNA since day one, and this will not change. Fitbit will continue to put users in control of their data and will remain transparent about the data it collects and why. The company never sells personal information, and Fitbit health and wellness data will not be used for Google ads.”

At first you might think – great, that means all is well, right?

Not so fast. What’s missing in this entire press release is any commitment whatsoever to maintaining the Fitbit platform or ecosystem. Bizarre as that omission might seem (since that’s what Fitbit is so well known for), it means Google is keeping all options on the table – including burning down that ecosystem to fold into other projects (which historically the company tends to do for acquisitions, they’ve acquired at least 229 companies as of today).

In fact, when I asked Fitbit’s PR team about any commitment (at all) to existing Fitbit users – they said:

“The release and blog post are the comments for now.”

In other words – ‘no comment’.

That could be taken both ways. But I know better. We all know better.

When it comes to acquisitions, if a company plans to keep something – they say it (and usually say it loudly and proudly – like they did above with the security/privacy bits). If a company has even the slightest thought of not keeping it, they say nothing. And if the company plans to burn it down, they definitely say nothing.

This is a pretty big deal for neither Fitbit or Google’s statements to address.

They do however offer one other line item around compatibility, which is:

“Fitbit will continue to remain platform-agnostic across both Android and iOS.”

And that makes sense. After all, Wear OS works today on iOS and Android devices, and there’s no reason to shift away from that. Most companies in this segment find that they have 60-70% iOS market share for consumers of these types of devices (as compared to far higher global Android market share). Thus, ditching iOS support would be a self-inflicted wound.

Impact on their competitors?

Interestingly, Garmin was asked this very question on their earnings call this week by Robert Spingarn of Credit Suisse. CEO Cliff Pemble said the following:

“So we’ve seen the speculation obviously around Fitbit and Google. It’s really hard to say what we can think about that without any kind of formal announcement and whether or not it’s even a real thing.

We believe that Fitbit’s customer base is very different from ours and our product focus is also different. So it’s not something that we believe impacts us and we’re not worried about it.

In terms of other opportunities, we look at every opportunity basically in terms of what it can bring to Garmin both in terms of technology or product lines. So we would evaluate any of those opportunities based on that and what we can achieve with it going forward.”

Of course, he brushes off the concern – but what he states in the middle paragraph is mostly untrue. Fitbit and Garmin have always had huge overlap at the low-end, and have always competed head to head there. They’ve referenced Fitbit as a competitor in their earnings calls and sales guidance for years.

However – there’s also some nuances to what he says. What he’s probably trying to say is that ‘A Garmin customer is less likely to become a Fitbit customer, whereas a Fitbit customer is more likely to become a Garmin customer’. Meaning that the athlete-focused feature set of a Garmin watch is easier to ‘upgrade’ into from a Fitbit device, but harder to go back to a Fitbit device once on a Garmin (speaking purely from a feature standpoint). They have overlap, but the bulk of Garmin’s *revenue* comes from their mid-range and higher-end devices, not from the activity trackers that they still compete with Fitbit on.

The other two players this impacts are Apple and Samsung.

But predicting how it’ll impact them is a tricky beast. Obviously, this will give Wear OS strength over time, but not immediately. Apple’s integration between phone and watch is second to none. The cleanliness of that integration is in many ways the cleanliness of Fitbit as an ecosystem. Whether or not Google can find a way to port not just the overarching fitness platform to Google proper, but also retain that cleanliness remains to be seen.

I don’t see this making any appreciable negative impact on Apple (or Samsung) anytime soon. I could, however, see this having a detrimental effect on Fitbit sales near-term, whereby people actually end up on an Apple Watch (or other competitor) due to uncertainties around Fitbit. As I often say, the ‘Best Buy’ effect. Meaning, consumers of this type of device are often heavily reliant on advice from someone in a brick and mortar store like Best Buy, who can easily make an off the cuff statement when asked by a consumer which device is recommended – only to have that person respond ‘Well, Fitbit just got bought by Google and we don’t know how that’ll end up’. The person turns and buys a competitor device instead.

Wrap-Up:

I’m never one to want to see less competitors in the space. But I’m not sure there was any other realistic option here. No, Fitbit wasn’t going to die this year or next year, or even in 2021. However, they were facing an issue of not being innovative anymore, which in turn causes loss of market share. Their Versa 2 launch this past summer was a prime example of that – where the global reaction was ‘shrug’. Combine that with the continued shift from lower-end activity trackers to highly integrated smartwatches like an Apple Watch, was becoming the perfect storm for the company.

They couldn’t really seem to fully lock and complete the various projects they’d announced. Whether that was the sleep tracking that took over a year to get out the door, or even broader music streaming services adoption. It was like things were stalling, as if the ship was just getting too heavy.

I think this acquisition though gives Fitbit a second life – but also gives Google a second life in the wearables realm. Remember, aside from Fossil, almost nobody was rolling out new watches with Wear OS. It had kinda sputtered.

I’m hoping we look forward to Fall 2020 with a Google Watch announcement. Something that can compete with Apple Watch in the mass market arena, but perhaps also have the flexibility to compete with companies like Garmin and others in the athletic focused space.

With that – thanks for reading!

FOUND THIS POST USEFUL? SUPPORT THE SITE!

Hopefully, you found this post useful. The website is really a labor of love, so please consider becoming a DC RAINMAKER Supporter. This gets you an ad-free experience, and access to our (mostly) bi-monthly behind-the-scenes video series of “Shed Talkin’”.

Support DCRainMaker - Shop on Amazon

Otherwise, perhaps consider using the below link if shopping on Amazon. As an Amazon Associate, I earn from qualifying purchases. It doesn’t cost you anything extra, but your purchases help support this website a lot. It could simply be buying toilet paper, or this pizza oven we use and love.

Can’t help but think about how well the acquisition of Nest by Google went. Spoiler alert: It was a total shitshow that totally broke a potentially interesting company and it’s employees.

I’m glad I’m not a Fitbit user, honestly. I can’t see anything good coming out of this. Call me pessimistic if you like, we’ll see how things look in 2 year.

I think the bigger issue is going to be that Google now has all that much more information about its products (aka: users). Google has become about as evil as it gets. I can honestly see them taking the health/user data and then killing off the company like they did with Nest. Even if they do nothing with the user data, Google kills off too many projects to rely on them in any way. If it’s not search or gmail, who knows what will happen to your favorite service in one, two, or six years’ time. I could actually, honestly see a design where they monitor your heart rate and other vitals while in proximity to one of its customers’ (advertisers) stores or products – then pushing an ad to your phone to target you at an ‘optimum’ time.

Bill Hicks was right about people in marketing and advertising (i.e., Google and Facebook). I just wish that all of them would follow his suggestions.

Similar hardware manufacturer acquisitions by Google/Alphabet are Motorola Mobility, Nest Labs, and Android.

Google is great with software but their 1st party hardware has mostly been a market flop. Currently Google makes Pixel hardware that is good quality but their distribution and market penetration is poor.

Two of those did not go so well. Android turned into a software project. If the goal here is to create a replacement reference hardware platform and software platform to WearOS to enable an ecosystem that depends on their backend infrastructure and funnels data and services revenue back to Google, then this could be a big deal. If they are going to take over FitBit and continue make 1st party wearables and try to compete directly with Apple and Garmin, I think it is likely to be a failure.

The real question here is what what Google is going to do with Fitbit data, that could be scary!

I don’t think Fitbit provides any data to Google that they didn’t already have. If anything, I think they’ll use this to rebrand FitBit and promote their own high-quality Smartwatch device.. This is honestly good news for 3rd party activity watches like Garmin. People will begin to associate Fitbit with watch brands like the Apple Watch and Samsung Watch and less of a fitness device, meaning that Garmin and like brands will have more market share of the athlete user group.

Great writeup all around

This website was the first to call the AW S3 price redux as being an effective death knell to $FIT. The upcoming service offering never stood a snowball’s chance

I took Pemble’s comment as clear indication Garmin is unconcerned with any Vivos going forward except for Vivoactive and Jr. Nor should they be

Also makes me glad I’m not a fitbit user. Google does some seriously creepy stuff. I doubt Google will even keep their promise about user data being protected. That’s not Google’s business model.

Exactly – Google is an ethically challenged corporate entity.

Do you think that the Google Fit platform will merge into the Fitbit platform? The two seem mostly redundant and Fitbit is the better experience between the two.

Call me over optimistic but I’m intrigued by this, I quite like Fitbits idea of doing things, they don’t always get it right but generally they are good on the fitness side for me compared to someone like Samsung lets say.

If they could design an attractive WearOS round watch, add Fitbits battery life and fitness features then do a deal with Firstbeat to include some of their wellness features they could have an Apple Watch competitor in a few years time.

I think there is a still a gap for a fitness first, smartwatch second device. Apple great smartwatch, awful battery life, Samsung, lovely smartwatch, fitness tracking is a mess, Garmin & Polar, excellent fitness but not so great on smartwatch features.

Maybe Google & Fitbit aim to capture that market?

I have the charge, and earlier this year they pushed a FW update that bricked a lot of watches. Mine wasn’t one of them, but I am leery of any further updates.

What I like is the battery life. Over 1 week.

Exactly my thoughts—the Fitbit products are okay to good, but the service is/was poor. Any issues and Fitbit would offer me a discount on BUYING another similar product. No repair or replacement, BUY ANOTHER ONE. That’s not a good way to treat customers who took a chance to buy a barely affordable fitness tracker/watch when compared to major brands like Garmin, Polar, etc. Oh and the oddball charger port stinks!

I’ve never been a Fitbit user, and now I’m glad. I would not want Google having access to my health data. The only company I’d trust less with my health data is Facebook.

Fitbit loses money. Every. Single. Quarter. This is a company that went from a $50 share price at IPO to under $3 earlier this year. Its market share has been decimated by Apple Watch at the high end and Xiaomi/Huawei/Amazon no-names at the low-end. If anyone is going to turn Fitbit into a real Apple Watch competitor its Google.

Respectfully – Fitbit has lost some money, but is profitable in some quarters, such as many 4Qs. Both in make believe non GAAP methodology, as well as cash flow. Not every single Q.

Another vector to pull user physiological data in from, and the cultural cross-fertilization may be worth the price even if none of the code base ultimately survives.

Hope the remaining Pebble & Fitbit contributors keep pushing hard. Maybe they’ll check out the weather in Kansas.

Maybe they can resurrect some of that Pebble Paperwhite technology (or a hybrid/dual layer that mostly remains readable and non-battery draining till it has to be)… Slap wearOS in there and add some more fitness features. Put that Frankenstein together and you might actually have a fitness smartwatch with excellent battery life and the extensibility of Google’s platform.

Also wish that someone does this but it is highly unlikely. Google goes after mass market appeal, so they likely to go with AMOLED/OLED and talk about how dark mode on those screen will give a slight bump in battery life. Best bet is Polar with a transflective M600 successor but even that is highly unlikely.

I’d love to see polar make an m600 successor, but I think it didn’t perform (sales-wise) as well as they hoped. I think they’ve been spooked away from wearOS. Either that or their product development lifecycle is slower than my 3-legged dog named Molasses.

+1

My Pebble was by far the best smartwatch commitment (functionality vs battery) i found. I hope Google can use their Paperwhite patents and IP to leverage the smartwatch market again.

You provided some interesting tidbits here that hadn’t considered before, but I’m still unsure of the big question: Why? Why is Google buying Fitbit?

It doesn’t make much sense to me either.

the only insight I could offer to answer your question would be “because they can”

If they want to be in the general market two years from now it is a reasonable step to take. May be a slight advantage to having their IP compared to letting someone else acquire it.

If they don’t want to be in the market in the long-term then they can spin the combined entity off at a point where it is reasonably self-standing.

Perhaps they are going the opposite direction as iOS and want WearOS to be an umbrella brand. The coders of the world may cringe, but it isn’t clear the average consumer actually cares about tech under the bezel. They look for the keywords that remind them of pleasant UX experiences & let the app store tell them if they need to pay more to play.

“If they want to be in the general market two years from now it is a reasonable step to take.”

Exactly.

Ask yourself this: Is there any scenario you can think of where 5, 10, 15 years down the road people won’t be wearing smart watches?

No, of course not. So – how do you, as Google, start to actually compete in the game (because WearOS clearly isn’t it)? Well – you start by buying the #2 player in North America (and probably Europe if I were to look it up).

Will Google screw it up? That’s anybody’s guess. As others have pointed out, Google has a serious issue with tossing products that don’t make them X Billions in year 1. Or even year 2. That’s going to be a challenge for people to swallow.

We shouldn’t also forget the this deal brings with it Pebble IP. I know its not the fancy technology brought by AMOLED/OLED displays but the Paperwhite technology has the best battery life by far without compromising functionality.

“ Will Google screw it up? That’s anybody’s guess.”

My guess is yes, but In the ‘meh’ way stated. Like when intel acquired that HUD company, there’s some ip & competition strategising but the death knell of Fitbit has been rung

The paperwhite ip might be interesting but as hardware tech advances I think it will become obsolete in all but a few cases & then will google want to maintain different display methods?

Data. They won’t use P.I.I. lest there be an uproar, but the largest collection of sleep data in the world for example has value to companies like Google. The hardware/OS is icing on the cake IMO.

Thanks for the replies, everybody. After I posted this I read a Rick Osterloh quote somewhere (couldn’t find it again) that alluded to the idea of Google acquiring Fitbit in order to make wearables. Seems like it could be a good thing. Google has stumbled a bunch of time in hardware (but not every time). Hopefully their bad experiences from the past will inform a positive outcome for future Fitbit devices.

Given the acquisition was three years ago and 5-6 product cycles since, whatever ip fitbit wanted to integrate, has been. So I think we *can* forget about Pebble.

Lol & when intel also aquired ti’s puma & mediaroom ,havok, & Indeo all have since been sold off or shutdown

Hi Ray

It is interesting that you should pick this up as it was only yesterday that there was a press article in the specialist competition regulatory press that identified this deal as squarely in the European Commission’s merger control radar, not necessarily because of the overlaps in consumer products but due to Google’s position in user data.

This is not unheard of (e.g. Microsoft/LinkedIn) and Apple got a torrid time on its Shazam acquisition last year and I’d be hugely surprised if this deal got through without a detailed European Commission Phase II investigation which is definitely not a formality.

Within the US, the main concern is antitrust concerns around mergers, for which the is very little concern here. The market is robust with competitors above and below Fitbit and Google in size – so that’ll be an easy win, especially biz-political climate. For all the current day to day news talk around privacy, no aspect of the current US regulatory body will have any decision based on privacy. So that’s a non-issue.

Within Europe, I’m sure regulators will make a racket like always around the tech giants, but at the end of the day nothing will come of it. Because if it pivots on privacy Fitbit can easily point to their existing work around things like GDPR and privacy and simply say it’s continuing to mirror the same in Google (and that the EU had no issues with Fitbit and privacy previously). There’s little EU regulators will be able to do about that at this juncture, as it’s not pertaining to anti-competition facets.

Much of what we hear in the news is mostly noise, put up by both sides of the coin to try and gather support. The actual people doing the regulating are generally pretty passive for mergers, except in the rarest of scenarios. Given we’re talking two companies with declining wearables market share, I don’t see it anything but an easy pass.

I agree – I don’t think they can block it. It will go to a Phase 2 review – which means it won’t close in 2020.

As an anti-trust lawyer I disagree with you that there’s no competition theory of harm. Whilst there isn’t one within wearables, I think you always have to look at the impacts across the Google product network and how the transaction potentially strengthens Google more broadly. I think the theory of harm, if I wanted to attack this is the same as Microsoft/LinkedIn – not the issue with actual horizontal overlaps (there were none in Microsoft/LinkedIn) but an aggregation of increased data and integration that risks foreclosing other competitors for example other re: WearOS (who cares) but also potentially raising concerns that Google will do exactly what it did with Android and the App store in relation to wearables.

The other concern with the aggregation of increasing amounts of data controlled by Google is it strengthens e.g. their advertising position and potential creates or enhances a dominant position in targeted advertising. Given the Commission has recently enforced against Google’s advertising suite for abusing its dominant position, I think there will be significant scrutiny of a transaction that potentially further strengthens that position.

As I said, I suspect it will get cleared, I am confident it won’t get cleared in Phase 1 and therefore, will go to an in depth Phase 2 review, which means the transaction almost certainly won’t close in 2020.

Double check the phrase “…and challenges that Fitbit has exceeds everyone where.”

Thanks!

Google really needs a better cpu then the Snapdragon Wear 3100. cpus on phones keep getting major improvements but very low power cpus for watches don’t see much change. Apple has the advantage of their own custom cpu

My bet: Sooner or later it’ll end up at https://gcemetery.co

??♂️

This makes me glad I just switched to Garmin.

If I were a reporter my headline would be “Google buys Fitbit”. My tagline: “Death of wearables maker creates oligopoly challenges for Apple Watch and Garmin’s fitness trackers”. I think the biggest impact will be that Garmin can now simplify their fitness tracker lineup, slow release cycles and make it a profitable product line. Yeah, I know that neither the smartwatch nor fitness tracker markets are that small but this is the death knell for Garmin’s major competition in the fitness wearables market. At best, Fitbit probably owns IP that will benefit Alphabet in some way that we may never know.

I find it interesting that they chose to announce it on Friday. I may not know too much about PR, but I thought that such timing was reserved for bad news?

Ray, in the sentence “ keep in mind that global IDC tracking isn’t a great indicator of North America/European sales”,

Can you please tell why and point to more accurate indicators? I would much appreciate, many thanks.

The main challenge with the global tracker is that it’s worldwide. At first that sounds fine, but then if you look at those top companies listed there, outside of Apple, it’s essentially the large Chinese companies selling primarily China (and some other parts of Asia). Again, specifically for wearables.

IDC does do US and European specific estimates, though my Google-Fu wasn’t finding the latest versions easily. Those are far better for assessing demand in those regions.

There’s nothing wrong at all with the Chinese trackers, it’s just that they’re selling $15 units versus $200 units. As such, they’re going to sell more volume. They might not actually sell more revenue. That also doesn’t matter one way or the other – what matters is profit.

Hope this helps!

One can certainly predict a higher end Fitbit with WearOS now. Somewhat Akin to the Polar M600.

My guess/hope is that the Fitbit process will be similar to how Waze/Google maps co-exists. Where Google Maps has picked up Waze features, but Waze for the most part continue to run their business independently.

What would be regrettable is if Fitbit is managed like Nest was and burden with trying to be the center for Google Health platform and thus inheriting all the Google internal requirements and drifting away from what Fitbit did well.

Damn. I stopped wearing my Blaze a while ago because the battery was crapping out. The plan was to wait till black friday and get the Versa 2. Garmin has a much more attractive fitness tracker offering, but everyone I know is using fitbit and the social features are what interest me the most. Kind of at a loss as to what to do now, though. Seems like I’d be buying a dead product.

One consequence of a big exit like this is that the fitness tech market will continue to get flooded with VC money, which isn’t half as good for consumers in that market as it sounds. Because overfunded money bonfires will continue to make life difficult or impossible for more sustainable businesses. Sometimes even *within* a company, as illustrated by Strava, the universally beloved cycling community that it could be if it was funded smaller, vs Strava, the failing mainstream any-sports tracker that it is.

Hi Ray,

Wanted to check if this was a typo above: “they’ve acquired at last 229 companies as of today”

did you mean “at least”

Great post and well worth the read! curious to see how this all pans out as I’d like to see a good wear os watch with descent battery life.

Thanks!

If rumors are accurate, Apple Watch Series 3 for $129 via Black Friday sales at Walmart, Best Buy, Amazon, etc.

Coffin, meet nail.

I am a Garmin guy for automotive GPS, having other GPS’s in the past. For watches, in my opinion, Fitbit is the best, given its good battery life (Ionic) and features which I use. I hope Google does not change or dump the reason I got my Ionic.