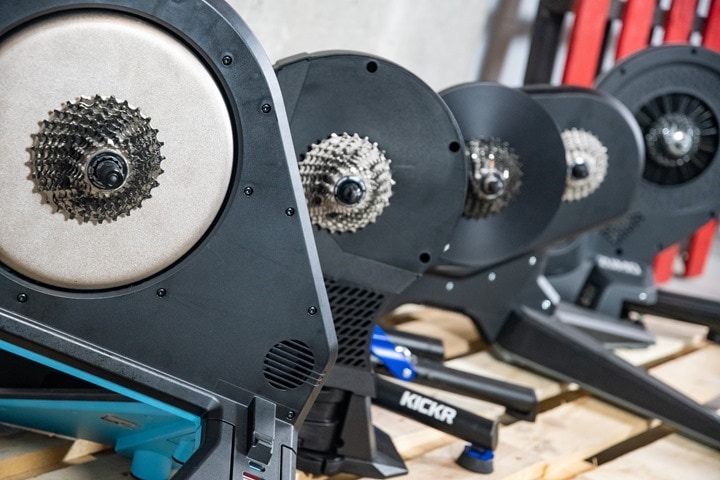

Heads Up! There’s a very solid deal on the Wahoo KICKR CORE 2 right now at $399/EUR/GBP. This trainer just came out last fall, and is easily one of the best deals right now for indoor training.

I’m DC RAINMAKER…

I swim, bike and run. Then, I come here and write about my adventures. It’s as simple as that. Most of the time. If you’re new around these parts, here’s the long version of my story.

You'll support the site, and get ad-free DCR! Plus, you'll be more awesome. Click above for all the details. Oh, and you can sign-up for the newsletter here!

Here’s how to save!

Wanna save some cash and support the site? These companies help support the site! With Backcountry.com or Competitive Cyclist with either the coupon code DCRAINMAKER for first time users saving 15% on applicable products.

You can also pick-up tons of gear at REI via these links, which is a long-time supporter as well:Alternatively, for everything else on the planet, simply buy your goods from Amazon via the link below and I get a tiny bit back as an Amazon Associate. No cost to you, easy as pie!

You can use the above link for any Amazon country and it (should) automatically redirect to your local Amazon site.

While I don't partner with many companies, there's a few that I love, and support the site. Full details!

Want to compare the features of each product, down to the nitty-gritty? No problem, the product comparison data is constantly updated with new products and new features added to old products!

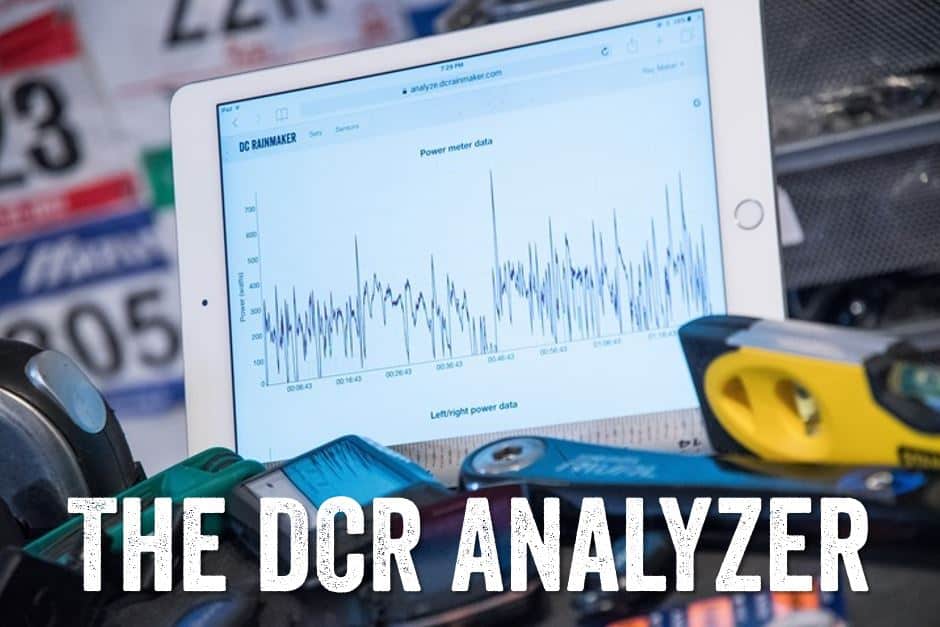

Wanna create comparison chart graphs just like I do for GPS, heart rate, power meters and more? No problem, here's the platform I use - you can too!

Think my written reviews are deep? You should check out my videos. I take things to a whole new level of interactive depth!

Smart Trainers Buyers Guide: Looking at a smart trainer this winter? I cover all the units to buy (and avoid) for indoor training. The good, the bad, and the ugly.

-

Check out my weekly podcast - with DesFit, which is packed with both gadget and non-gadget goodness!

Get all your awesome DC Rainmaker gear here!

FAQ’s

I have built an extensive list of my most frequently asked questions. Below are the most popular.

- Do you have a privacy policy posted?

- Why haven’t you yet released a review for XYZ product you mentioned months ago?

- Will you test our product before release?

- Are you willing to review or test beta products?

- Which trainer should I buy?

- Which GPS watch should I buy?

- I’m headed to Paris – what do you recommend for training or sightseeing?

- I’m headed to Washington DC – what do you recommend for training?

- I’m from out of the country and will be visiting the US, what’s the best triathlon shop in city XYZ?

- What kind of camera do you use?

-

5 Easy Steps To The Site

In Depth Product Reviews

You probably stumbled upon here looking for a review of a sports gadget. If you’re trying to decide which unit to buy – check out my in-depth reviews section. Some reviews are over 60 pages long when printed out, with hundreds of photos! I aim to leave no stone unturned.

Read My Sports Gadget Recommendations.

Here’s my most recent GPS watch guide here, and cycling GPS computers here. Plus there are smart trainers here, all in these guides cover almost every category of sports gadgets out there. Looking for the equipment I use day-to-day? I also just put together my complete ‘Gear I Use’ equipment list, from swim to bike to run and everything in between (plus a few extra things). And to compliment that, here’s The Girl’s (my wife’s) list. Enjoy, and thanks for stopping by!

Have some fun in the travel section.

I travel a fair bit, both for work and for fun. Here’s a bunch of random trip reports and daily trip-logs that I’ve put together and posted. I’ve sorted it all by world geography, in an attempt to make it easy to figure out where I’ve been.

My Photography Gear: The Cameras/Drones/Action Cams I Use Daily

The most common question I receive outside of the “what’s the best GPS watch for me” variant, are photography-esq based. So in efforts to combat the amount of emails I need to sort through on a daily basis, I’ve complied this “My Photography Gear” post for your curious minds (including drones & action cams!)! It’s a nice break from the day-to-day sports-tech talk, and I hope you get something out of it!

The Swim/Bike/Run Gear I Use List

Many readers stumble into my website in search of information on the latest and greatest sports tech products. But at the end of the day, you might just be wondering “What does Ray use when not testing new products?”. So here is the most up to date list of products I like and fit the bill for me and my training needs best! DC Rainmaker 2024 swim, bike, run, and general gear list. But wait, are you a female and feel like these things might not apply to you? If that’s the case (but certainly not saying my choices aren’t good for women), and you just want to see a different gear junkies “picks”, check out The Girl’s Gear Guide too.

great analysis. Makes me glad I have USAA and they cover my bikes for nothing extra.

Perfect timing for this post! Thank you for saving me hours of reading :) I got a new carbon bike and am going to be covering with insurance and I did look into this plan briefly.

I ended up talking to my home/auto insurance and they added my bike under my HO policy as a scheduled item. In my case, theft and damage are covered and the deductible does not apply. The annual premium was minimal for $2500 coverage on thebike-less than $100 year.

Thanks Ray! I was actually thinking about this but hadn’t had the chance to drill into it.

THANKS FOR THE GREAT POST RAY! I also noticed that even if it did over part for part replacement someone like myself would still get Hosed. I have a 4 year old bike that I take very good shape of, but according tot he policy it is over 2 or 3 years and therefore depreciated. If it was stolen I wouldnt get enough to replace it!!

Great post Ray!

Hey Ray,

Nice post. I just thought I’d pass along a quick note regarding this issue:

My dad was run off the road by a car last season while riding his Look 585. One of the seat-stays was cracked as a result and the bike shop advised that it was no longer safe to ride. However, the bike was scheduled on his home owner’s insurance and after a quick verification of the damage, they sent him a check for the value of the frame. Simple as that.

Bottom line: The CyclePro thing smells like a scam; just schedule your bike on your HO insurance and you should be good to go.

To say nothing of the crimes committed against the English language in their literature…

Luke: you do realize that’s how most car insurance works too, right? If someone steals my 2003 VW, I’m getting a check for $5,000, not a 2011 VW.

I thought USAT said something in their mission statement to the effect of not pairing up with sub-par companies. I understand insurance companies are, like every other company, in it to make money… but this borders on one of the worst insurance policies, coverage-wise, out there today. If USAT was REALLY worried about their image, you’d think they would have paired up with someone else…

As a lot of others have pointed out, I schedule my tri bike (and components) and my road bike under my homeowner policy. Much better deal! And, NO loopholes to worry about! Covers me everywhere I go with the bike.

As always great analysis, basically what a rip off!

I did not go into this level of analysis, but I did look at the policy and realized it was a piece of shit. Why would USAT put their name on it?