As I noted just a few hours ago, when I’m sufficiently bored, I listen to investor calls for companies in the segment. In today’s case, that was two investor calls. It’s that time of quarter with plenty of earnings calls to be had.

As with the Garmin call earlier today, the Fitbit call was packed full of tidbits. In fact, I’d argue far more tidbits than the Garmin call. Fitbit got into models sold, plans for their upcoming smartwatch, and even longer range plans for medical-focused efforts.

Now of course, not every company in this segment does investor calls or similar reports. It’s mostly just the biggies that are publically traded entities. So no reports or calls from Wahoo, PowerTap or countless others. But there are ones from GoPro, Fitbit, Garmin, and Apple. Now I’m not going to talk deep financials here. Meaning, stuff like operating growth, gross margins and blah-blah-blah, I mostly don’t care about. Instead, it’s largely the non-financial tidbits I’m interested in.

Note that I won’t do these for every quarter or every company. Just cases where I think there are enough worthwhile things to post about. Sort of an extended version of what I sometimes include in the ‘Week in Review’ posts. This is one of these cases.

Smartwatch, Smartwatch, Smartwatch:

Everything at Fitbit is clearly riding on their upcoming smartwatch. At this point no precise date, name, price point, or complete feature set has been announced. However, they did detail some new tech specs of it. CEO James Park noted:

“Our upcoming smartwatch device will deliver a combination of features that consumers have not yet seen in a smartwatch, including a health and fitness first focus, cross-platform compatibility, water resistance to 50 meters, industry leading GPS tracking, and an easy to use software developer kit that will enable innovation and deeper connections to the healthcare system. All of this will come with multi-day battery life at an attractive price.”

Well then, looks like Fitbit can actually make something waterproof after all!

To be fair, they’ve always had ‘water resistance’, but their definition of that term has often been at odds with the rest of society’s. Either way, this is good news.

The ‘multi-day battery life’ is an interesting term. That sounds very much akin to a handful of the Android Wear devices and even the Apple Watch. Meaning that the display is high resolution and likely not always-on. This seems confirmed from the various leaked images.

So what is the timeline then? Well, they haven’t announced a specific date yet, but it’s pretty clear from a few different quotes when it might be available. To begin, in their prepared remarks they said:

“The launch of our smartwatch is on track, and it will be available for the holiday season.”

An investor/analyst later followed up on this, asking how the smartwatch might impact Q3 revenues (which is July-September), to which they answered:

“The vast majority of our revenue in Q3 is related to legacy products”

That means that the smartwatch will likely start shipping (or at least be announced and accepting orders) by the end of September, since they didn’t use wording to imply ‘all revenue’. And that’s logical. Fitbit has traditionally announced products on/around the 1st week of September tied to the IFA trade show held in Berlin September 1st through 6th.

They also noted that their revenue projections “Assumes shipments of smartwatch for the holiday”. As part of that they did note that the smartwatch will have a lower gross margin than the activity trackers, citing it being a more complex device to build and being their first attempt at it (which isn’t really true per se, as they’ve built similar devices before in both the Blaze and Surge).

So what about apps and app stores? Well, glad you asked:

“We’re going to launch with an app gallery and there’s going to be a select number of partners that we launch the product with. The SDK [software development kit] and the developer tools are going to be available at the launch of the product, and we expect apps from a lot of other 3rd party developers to start to stream in after the launch since it’s going to take them a little bit of time to learn the tools and the nuances of the developer SDK and the product itself.”

This is in line with recent reporting from The Verge about the app platform.

Interestingly, Fitbit did sidestep a question about whether or not apps would provide incremental revenue, which is a long way of asking whether or not apps will cost money. Fitbit went off talking about some of their healthcare/enterprise partnerships and revenue there, but never actually answered the original question. So we’ll have to see whether they adopt a model like Garmin or Pebble originally (all apps are free), or whether they adopt one more in line with Apple (prices can be set by a developer).

Speaking of Pebble, they provided more insight into how they’re fitting into Fitbit:

“Really focusing on re-use of software platforms and making sure we get a lot of leverage out of the software that we write, and I think you’ll see the benefits of that when we launch our smartwatch in the holidays. It’s going to be the first product that utilizes the IP and the team that came onboard from Pebble. And there’s going to be a lot of efficiencies in the developer tools that they’ve created, not only for internal use, but for external developers as well.

Lastly, don’t expect much in the way of price drops of the existing Blaze. They noted that they see that as an entry-level device in comparison to the new smartwatch, so whatever that smartwatch is priced at, it’s going to be more. Fitbit also notes that the new smartwatch will have features that “the market hasn’t seen yet”.

Which, is a pretty darn tall order to fill. Looking forward to that!

Fitbit sold a crapton of units:

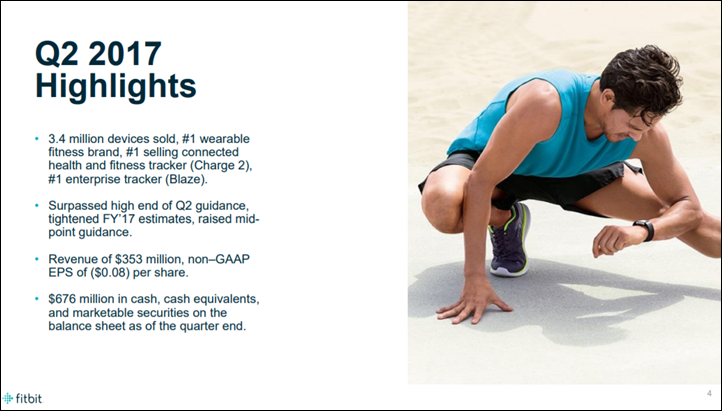

No matter how much Fitbit shrunk compared to 2016 (and it was a lot), at the end of the day they still sold 3.4 Million units in Q2 (April-June). That’s a lot of units. The Fitbit Charge 2 was noted as their #1 selling tracker, and they generated some $353 Million in revenue on those 3.4 Million devices.

Insofar as device sales go, they made this interesting claim:

“Our Blaze device outsold all Android based smart watches in the US in the second quarter, and it is the best selling device in the smartwatch category on Amazon.”

That’s not a particularly surprising thing. Android Wear smart watches are such a fragmented market (in terms of being so many options), that the wealth is distributed across a huge group. Though, even in combination, I suspect they easily outsold them too. The reality is very few people in the grand scheme of wearables are buying Android Wear devices.

The next comment was also really interesting:

“38% of the activations in the quarter came from repeat customers. With 39% of the repeat customers being re-activated, having been inactivated for 90 days or greater.”

Meaning that almost 40% of Fitbit device purchases were existing customers. That tells you that Fitbit users are generally quite happy. And even more interesting is that almost 40% of those same customers hadn’t used their previous Fitbit device in more than 90 days. Meaning that these were people that for whatever reason had seemingly given up on Fitbit, but that Fitbit managed to lure them back.

Unsurprisingly, almost all sales came from products introduced in the last 12 months:

“New products introduced over the past 12 months represented 81% of the revenue.”

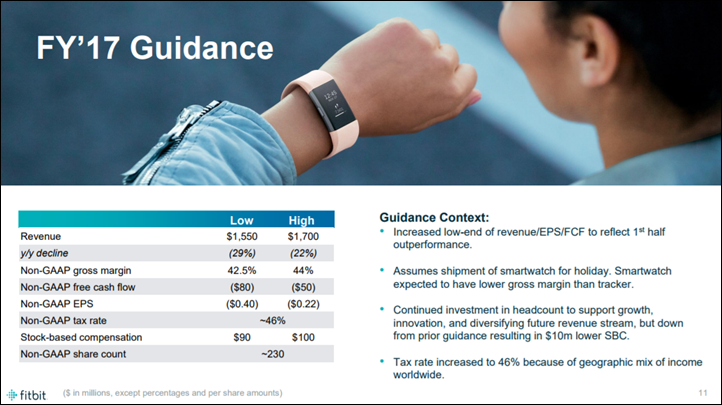

However, do keep in mind that at the end of the day Fitbit’s total revenues are down some 40% compared to 2016, and they expect a year over decline of 22-29%. That said, they see 2017 as a turning point for the company, noting:

“2017 is a transition year for the company. After launching two new products in the first half of 2016 and higher inventory in the channel in the second half of 2016, growth comparisons will not be truly aligned until Q1 2018. But we continue to make good progress towards returning to growth and profitability moving forward.”

Translation: “2016 was awesome-sauce. Thus any comparisons from 2017 to 2016 will make us look pretty ugly until 2018. Then we can talk comparisons again, because we’ll be comparing a pile of great new products to a bad year in 2017”

Interestingly, Fitbit’s average device selling price is $100.77 (of all sales), and they on average sell $3.98 worth of accessories (meaning that probably about 1 in 10 people buy an accessory, since most accessories cost ~$40-$50). They also noted that premium services from Fitstar continue to be “immaterial” as far as revenues go. No surprise there, the app on the Blaze is dismal, hardly enough to lure anyone over.

Activity Trackers Aren’t Dead Yet:

In contrast to Garmin’s investor call some 5 hours earlier, Fitbit hardly sees the death of the activity tracker market, or at least the wearables market.

Fitbit was also reiterated their position with IDC’s most recent analysis of where the wearables market is going:

“IDC recently reported that the wearables market expected to grow at a compound annual rate of 18% through 2021, to 240 million units, effectively doubling from where it is today.”

Now what’s important to understand here is the term ‘wearable’ vs ‘activity tracker’ vs ‘smartwatch’. And regrettably, there is no true standard. Fitbit themselves in this very call was guilty of interchangeably using the term ‘smartwatch’, both in reference to their upcoming offering as well as in reference to the Blaze. And they’ve used it in the past with the Surge.

And industry analysts and research groups like IDC and are equally as guilty of this. What was once a ‘smartwatch’ in IDC’s quarterly reports just a few years ago is now just considered a ‘wearable’, with smartwatches being a different category. The goalpost keeps moving. And that’s fine, but you just need to be super-careful anytime you read reports like these to understand whether you’re comparing apples to apples, or apples to cherries.

Now despite all the attention on the impending smartwatch, Fitbit answered one question noting that they still see a blend of devices as the key to their success:

“Our strategy has always been that we want to address the broadest possible market for consumers looking to improve their health. But that’s always going to require a variety of devices at different price points, feature sets, form factors, etc… For instance some people don’t mind wearing larger form factor devices, other people whether it’s domestic in particular or internationally, prefer smaller form factor devices. So we’ll always need that mix going forward.”

Fitbit also spent a significant amount of time talking about examples of how their products are used, especially in pseudo-medical scenarios. More healthcare scenarios without the medical certification. But I’ll cover this more in the ‘futures’ section.

Fitbit’s Users Like Each Other:

Fitbit talked a lot about their platform, and in particular their community aspects of it. And no doubt – that’s probably *THE* most important thing Fitbit has going for it, aside from brand recognition. Their devices are good, but not excellent. It’s their platform and ease of use for users across numerous demographics that is Fitbit’s biggest asset.

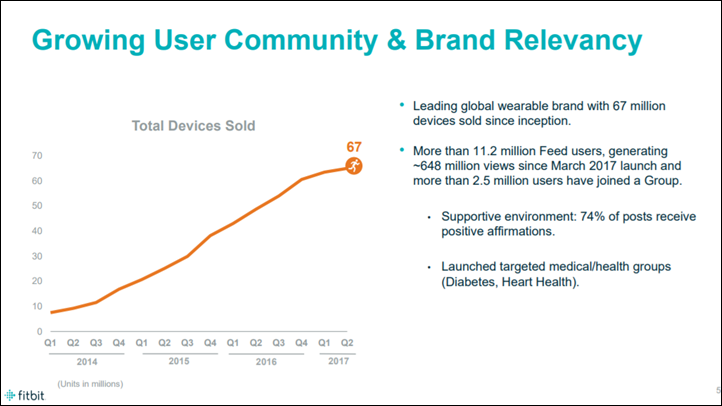

Earlier this year they rolled out the activity feed function, and as part of that some 11.2 million users now use it, and have generated 648 million feed views. I told my Mom to stop pressing refresh after the first 100 million, but she didn’t listen.

Interestingly, Fitbit noted that 74% of people receive positive affirmation of their status updates on the feed. My first thought? What the hell did the other 26% do that got them no positive feedback? Given you can’t get negative feedback from others, it means that 26% of people get a big fat nothing burger. Sad panda.

Of course, there is something super-telling on this slide: 67 Million devices have been sold, that means a ton of people aren’t using this platform (likely any longer). A huge ton.

The Future:

Now mixed in all this smartwatch talk was actually a number of tidbits about upcoming medical/healthcare focused efforts. For example, early in the call they talk about opportunities for Fitbit to push further into the healthcare realm, and really start to bridge more towards a medical device:

“One area of business opportunity we are exploring is to identify sleep apnea, a condition that is a precursor to a number of other chronic diseases. It affects an estimated 22 million Americans today, with 80% unaware that they have it. This represents an estimated $5 billion dollar total addressable market, that was previously only identified through an expensive sleep lab. Given the scale of our data and what we’re able to track, we believe that a Fitbit device could one day serve as part of a solution to recognize and monitor a number of other health conditions such as other sleep disorders, hypertension and arrhythmia.”

What’s most notable here is the focus on potentially becoming a medical device company. They hint at the challenges to that from a regulatory standpoint later in the call, and that can’t be overstated. In fact, they even noted higher legal costs this quarter, which is of course in large part due to a class action lawsuit against them around whether or not they were attempting to be a medical device without being certified by the FDA (and claims around accuracy of heart rate within it).

Asked when this monitoring of health conditions might occur, and whether or not it was part of existing devices or long-term planned devices. They said:

“We expect existing health use cases to be unlocked with products we have in the market today, and products on the short term horizon. This isn’t something that will take years to unfold. That said on the healthcare side obviously there’s a lot of business and regulatory issues that still need to be worked through. But from the technology side we see a near-term opportunity.”

Said differently: If the feds don’t get in the way, you’ll get this sooner rather than later.

Finally, regarding future acquisitions, such as they did with Pebble? That’s certainly possible. They noted that:

“We will peruse M&A [mergers and acquisitions] opportunistically, with the focus on accelerating our growth trajectory and acquiring talent to continue to scale our business.”

And this is pretty logical. The question any tech company has to ask themselves is whether or not they can do it in-house faster or cheaper. Almost any acquisition Fitbit does will likely be like Pebble – shuttering existing devices/platforms and keeping the underlying tech/talent.

—

With that, there’s your smartwatch update. Given everything, I’d expect launch probably between late August and early September, again likely around the major industry event of IFA. Certainly it seems like Fitbit is gunning for Garmin, Apple, and others with this release. It’ll be interesting to see exactly which part of the market they target. Are they aiming for the more casual athlete like an Apple Watch, or the more athletic-focused person like a Garmin Fenix? Time will tell.

Also, note that I don’t generally provide any further detail on unannounced products beyond what’s been listed within public statements by the company such as this investor call or interviews.

With that – enjoy your evening (or…morning as it may be here in Europe)!

FOUND THIS POST USEFUL? SUPPORT THE SITE!

Hopefully, you found this post useful. The website is really a labor of love, so please consider becoming a DC RAINMAKER Supporter. This gets you an ad-free experience, and access to our (mostly) bi-monthly behind-the-scenes video series of “Shed Talkin’”.

Support DCRainMaker - Shop on Amazon

Otherwise, perhaps consider using the below link if shopping on Amazon. As an Amazon Associate, I earn from qualifying purchases. It doesn’t cost you anything extra, but your purchases help support this website a lot. It could simply be buying toilet paper, or this pizza oven we use and love.

This is good news… Garmin and Apple need a competitor, and DCRM needs more devices to review.

Great news, can’t wait to see their new device in september.

Enjoyed reading this and must admit a good laugh at some points!

“38% of the activations in the quarter came from repeat customers. With 39% of the repeat customers being re-activated, having been inactivated for 90 days or greater.”

Yeap! I’m a repeat customer, having had 4 replacements in one year due to poor quality. My wife had 3 for her fitbit – glad she also helped Fitbits marketing engine!

Fitbit has a tough road ahead- so much expectation riding on the smartwatch. It would be really interesting to see how they deal with the battery life/functionality balance, a hard thing to achieve. Also interested in what is the initiative for the developers to come on board, they may end up with the windows mobile problem of having a good platform but lacking developers.

I would suspect the motivation would be having one of the largest smartwatch platforms out there (in a three-way race between Apple, Garmin, and themselves).

Wonder whether they will allow the developers to set their own prices -AppStore like. This smartwatch better be a huge step up over Surge and underwhelming blaze.

Well, since they don’t have any platform yet for developers, we’ll see if they are one of the largest. The race right now is Apple, Android and Garmin. Unless you think they will backport to their existing devices (which I doubt).

Hey Ray,

I was wondering on your thoughts about the halo sports device, since it made its way to slowtwitch. Are you reviewing a unit?

Thanks for all your work- you’re the be(a)st.

Hmm, interesting. Looks to be a little bit outside the range of things I normally review (like like COMPEX stuff is as well). Maybe when I’ve got some spare time. :)

Thanks a lot. I was already wondering for a couple of months what Fitbit was doing to continue their succes in the market. especciliay while the ‘big’ heartratewatch brands Garmin and Polar are not keeping up with the design of the favorite Fitbit models. Waiting now fot that 50m waterproof new model!

What do you think the odds are they deliver on “industry leading GPS tracking”? Could they really make a play for a highly accurate GPS smartwatch? I would argue basically every non-sport watch company (Apple, Moto, even Fitbit themselves, etc..) have offered pretty sub par GPS and sport tracking.

Hard to know really. I suspect it may depend on how tight they are battery-wise, that may chipset.

so nice to see that the activity trackers are getting better every day. They have come a long way but I’m really happy with my Fitbit.